CropLogic excels on the agtech and hemp growing fronts

Published 01-AUG-2019 12:41 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

While CropLogic Ltd (ASX:CLI) had plenty of positive news to reflect on yesterday when releasing its report for the three months to June 30, the big news from a financial perspective is likely to emerge in the December half when the group harvests its hemp crop from the company’s farm in Central Oregon.

Importantly though, as a global agronomy, farm management and agtech company, CropLogic also made significant progress in rolling out its real time crop management technology in the three months to 30 June, 2019.

The end of the June quarter marks the approximate midway point of the North American growing season.

CropLogic has a number of growth targets in the US, particularly in Washington State, Idaho and Oregon.

Strong progress in Washington State

The company’s Washington State operations commenced during the reporting period, with the season’s first CropLogic realTime site set up and providing real-time data.

Current realTime orders represent a 50% increase in Washington State, as compared to 2018 figures.

Two new sales zones were established to target growers in the US$2.8 billion apple and hops industry.

CropLogic realTime was trialled with apple and hop growers in the 2018 season after providing agronomy services for a period of time.

The systems were found to be robust and responsive, and grower response was positive.

The opening of these two zones presents a total addressable market to CropLogic’s Washington State operations of between $9.3 million and $18.6 million in Australian dollar terms.

Installations to date of CropLogic realTime in these new sales zones have been better than expected.

First hemp client in Oregon

One of the stated aims of CropLogic’s Hemp Trial Farm in Central Oregon, operated by the company’s wholly owned subsidiary LogicalCropping, was to demonstrate CropLogic’s agronomy, farm management and agtech expertise to the emerging US hemp market.

The first take up of this technology is in North Eastern Oregon, and it will be serviced out of CropLogic’s Washington State office.

CropLogic saw a 500% increase in the take up of CropLogic realTime in Washington in the 2019 financial year and a 600% increase in revenue derived from this technology.

The company currently services a variety of crops in Washington State, including apples, cherries, wine grapes, potatoes and hops.

The addition of hemp to this list is an endorsement of the robustness and versatility of CropLogic’s realTime technology.

Another first in Idaho

CropLogic has completed its first realTime installation in Idaho.

Management began to build the company’s presence in Idaho in October 2018 in preparation for the 2019 growing season by opening an office in Twin Falls, Idaho and appointing key staff, including a regional manager and an Idaho based sales agronomist.

Idaho, which neighbours Washington State, is the second largest irrigation state in the US and the largest in potato production.

The state is also the third largest in terms of dairy herd numbers and the second largest in milk production.

Dairy production in Idaho is almost all feed lot, resulting in strong demand for hay which is brought to feed lot facilities.

Idaho is a comparatively dry state and therefore almost all crop production, including potato and hay production, is done via irrigation.

As a key input and cost into their growing cycle, growers are keenly interested in monitoring their water use and soil moisture, creating strong demand for CropLogic realTime.

Interest grows in CropLogic’s agronomy, farm management and agtech services in Oregon proper, a key target region for the group.

CropLogic’s Hemp Trial Farm is not only a platform to trial a variety of hemp genetics and growing environments, but it is also a platform to demonstrate the company’s agronomy, farm management and agtech expertise.

As the Hemp Trial Farm project progresses, so does the interest in CropLogic.

This includes several sales enquires for CropLogic realTime in the Willamette Valley and as far south as the Medford region of Oregon.

Expansion of industrial hemp trial farm

CropLogic expanded its industrial hemp trial farm from 150 to 500 acres, allowing the company to develop additional reference data on hemp cultivation to enhance the existing technology offering, building further proprietary scientific knowledge within the sector.

Management conservatively estimates that the 500-acre farm will be able to produce approximately 800,000 pounds of industrial hemp biomass per annum.

This follows other producers within the region, who can reach up to 1.1 million pounds per annum on a similar size.

The hemp biomass market price is in a range between US$35 and US$45 per pound, and it has been ascertained from both management’s own investigations and through reference to third party indices for hemp market spot prices in the region that this would be a reasonable estimate to use in gauging the earnings that could be generated from the sale of this year’s crop.

Crunching the numbers, it would appear that underlying earnings of approximately $40 million is achievable.

This sees the group attractively priced relative to its market capitalisation of $25 million.

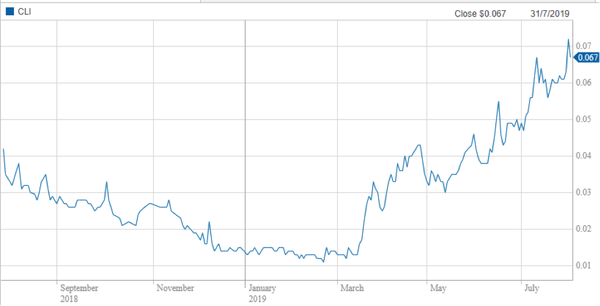

The undervaluation quite likely accounts for the company’s strong share price performance which as indicated below recently saw it hit a 12 month high of 7.6 cents.

However, given CropLogic’s heavily discounted enterprise value to underlying earnings multiple relative to other companies in the agricultural sector, and in particular those leveraged to the burgeoning hemp industry, the group could well experience further share price momentum, particularly as the harvest and sales period begins towards the end of 2019.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.