Baxter is Coming… and so is BYOD.

Disclosure: S3 Consortium Pty Ltd (The Company) and Associated Entities own 8,348,833 ONE shares at the time of publishing this article. The Company has been engaged by ONE to share our commentary on the progress of our Investment in ONE over time.

We’ve tried it.

We rate it.

It’s as easy as opening up your web browser on your phone.

Open the phone, tap, see, tap, learn, tap, data fed back into the system, tap, things happen, tap, close.

Done.

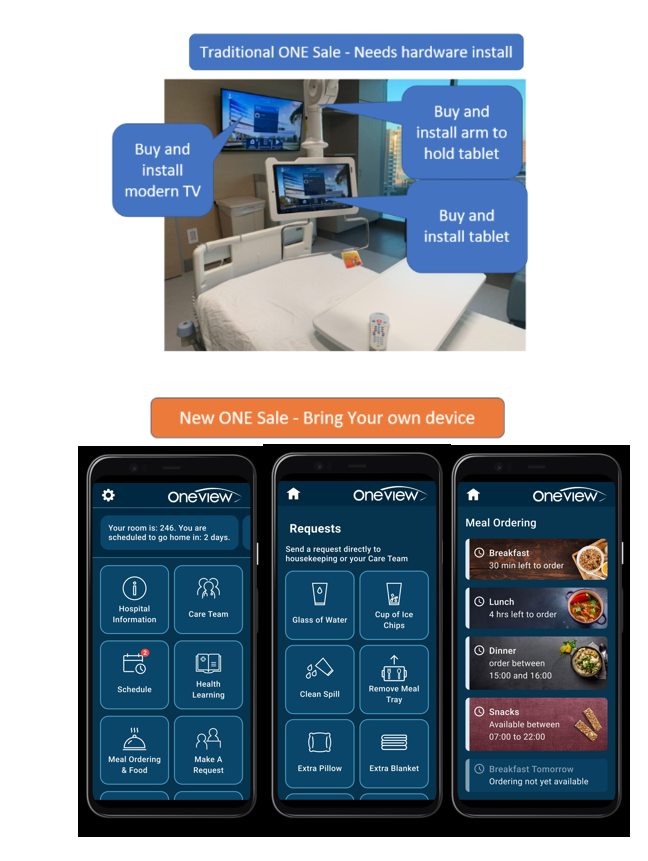

It looks like this:

(Source)

Imagine if the vast majority of US hospitals had this tech?

Only a small fraction have it now.

We think this makes the upside as clear as day for our healthtech Investment Oneview Healthcare (ASX:ONE).

We’re talking about getting everything you need from your hospital stay in the palm of your hands, on your phone.

It’s called Bring Your Own Device (BYOD) and we’re confident it will be a massive leap forward for healthcare.

It will connect patients to decisions about the most important thing of all - health, AND make hospitals run better.

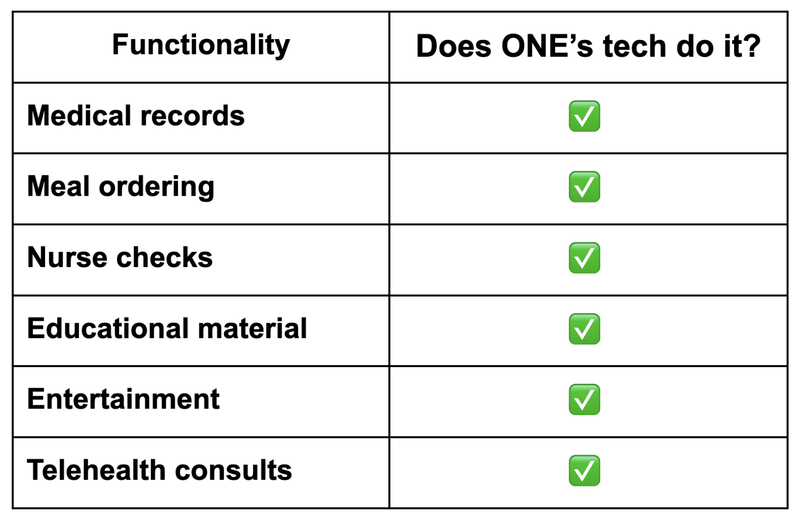

ONE is growing its revenue by rolling out a tech platform that connects all these systems in one easy to use user interface (UI):

These are the types of functionality that we think helped ONE seal a “value added reseller agreement” with $30BN capped NYSE listed Baxter International.

Baxter sells a lot of different health products, but most importantly for ONE, it sells actual hospital beds.

The giant Baxter controls up to ~75% of the hospital bed market in the USA - and its signed a deal with ONE so it can sell ONE products into its vast hospital customer base.

We’ve talked about how important the Baxter partnership is for ONE before.

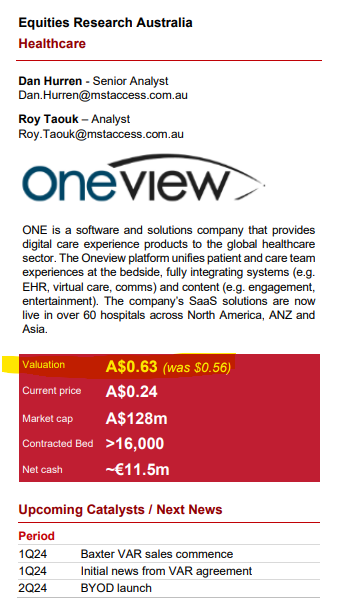

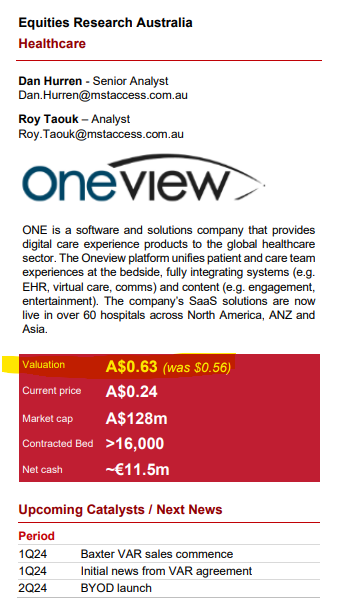

The prospect of frictionless BYOD and incoming Baxter revenue also has the analysts at MST Access putting a 63c valuation on ONE shares from its current level of 24c (more on this analyst report below).

(Source - Read the full January 2024 MST ONE research report here)

While that price target does look interesting, we should be clear that analyst price targets are based on a number of assumptions that may be incorrect - they (or us) don't have a crystal ball. It’s definitely possible ONE does not reach these share prices. This is a small cap tech stock. Never invest on a price target alone, and always do your own research.

The MST report also notes that Baxter may have up to 500,000 beds for ONE to now sell into - which is part of the justification for the valuation.

The reasoning being that if ONE is valued at 24c off its current contracted +16,000 beds - if it could quickly capture a healthy fraction of the available Baxter beds, the market should re-rate it to a significantly higher valuation.

We’ve been Invested in ONE since March 2021, and we think this is just the start of our ONE Investment journey - ONE’s tech will evolve over time to fit the needs of the world’s largest healthcare market and hopefully go truly global.

We met with the people developing the tech - they are passionate, driven types that are honing a modern solution to some of hospitals’ most pressing problems.

Hospitals always want to get better and ONE will build in new functionality into its products over time.

A decade of knowledge, expertise and tech are already built into the product.

Against this backdrop, ONE released its quarterly report last week which we think provided some excellent insights into its future trajectory.

Here’s what we really liked about ONE’s quarterly report:

- Baxter progress

- BYOD progress

- Minimal cash burn

- Healthy cash balance

It all adds up to another strong quarter for ONE.

Most importantly, ONE has now activated a partnership with Baxter - meaning potentially more than 500,000 hospital beds in Baxter's network are now available for ONE to sell to.

Last time one of our team members visited a hospital - they saw first hand that Baxter products were everywhere in the room.

And this was in Australia - the US based Baxter clearly has serious global reach.

Which is why we were so pleased to see in ONE’s latest update that the Baxter partnership commenced on 6 November 2023.

Here’s some pictures of the Baxter sales team getting trained up in ONE’s product - a 2 day training course to over 50 members of Baxter’s USA sales team:

We think that Baxter really wants to sell ONE’s product to their large customer base.

That’s because it makes their offering that much better - and gives both new and existing customers less reason to sign contracts with competitors.

As a result, we think that Baxter is going to put serious effort into incentivising sales representatives to drive ONE sales into Baxter’s customer base.

We think this partnership is the ideal fit for ONE after previous partnerships with Samsung and Microsoft failed to really take off.

AND - ONE said last week that they expect the first purchase orders from the Baxter agreement to be sealed in “the coming weeks”.

Currently capped at $160M, the recent MST Access analyst report discusses guidance of 3-5K contracted beds in the pipeline (again, more on this analyst report below).

Meanwhile, ONE also said in its latest business update that the company is engaged in “late stage negotiations” with two major US health systems for 2,800 beds which would take it to ~19,000 beds after revealing more than 16,000 beds are currently contracted.

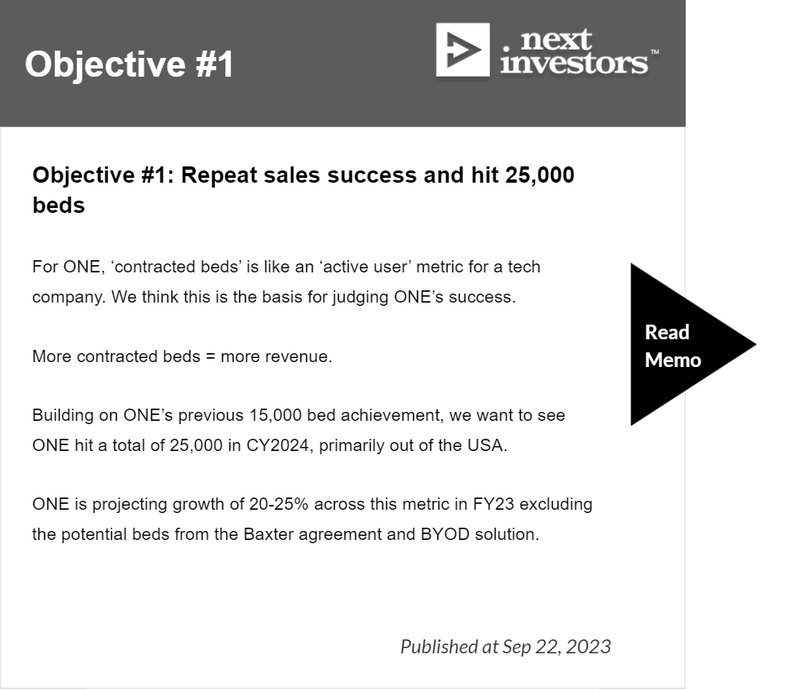

So good progress is being made towards our number one objective in our new ONE Investment Memo which is as follows:

And with every bed that ONE adds, it moves closer to achieving our ONE Big Bet:

Our ONE Big Bet

“ONE will sign on enough new hospital beds at an accelerating rate to achieve a $1BN valuation (based on 5x to 10x forward annual recurring revenue) and be acquired by a large health tech provider.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our ONE Investment Memo.

With a new phase of its growth underway, for the rest of this note, we’ll cover:

- What we learned from ONE’s December quarterly - (Financials, Baxter)

- What’s next for ONE?

- What do the analysts think of ONE’s progress?

- What could go wrong?

What we learned from ONE’s December quarterly - (Financials, Baxter)

ONE was the first of our portfolio companies to put its December quarterly reports out this reporting season.

Usually companies put this report out closer to the end of January (the deadline is typically the last day of the month).

If a company puts it out early, it's our opinion that management must be pretty happy with the results AND comfortable with its current cash position.

ONE put out both a quarterly cashflow report and a business update - here are our key takeaways from the two announcements:

- Contract wins & negotiations

ONE recently signed a deal with Dunedin Hospital in New Zealand - the first in NZ for the company.

ONE also confirmed that it was in “late-stage negotiations with two other major US health systems, representing over 2,800 beds”.

Given ONE currently has over 16,000 beds under contract the two companies would represent ~17.5% more beds versus ONE’s current portfolio.

- Bring Your Own Device (BYOD) launch progress

In last week’s update, ONE confirmed that the development and marketing of its phase 1 BYOD product had been completed and that agreements have already been signed with multiple hospital networks.

ONE signed up the #1 hospital in New York (NYU Langone Health) and Bon Secours Health System, one of the largest providers of private healthcare in Ireland (with 900 beds across 5 hospitals), to pilot its BYOD product this month.

It's now been ~ two months since the BYOD product was launched through ONE’s partnership with Baxter and sales are expected to start coming in over the next few weeks.

We covered the Baxter partnership and what it could do for ONE’s business in our last note here - We Just Increased our Investment in ONE.

- Financials update

One also gave a brief update on its financials for the calendar year ending 2024 and what's to come in Q1 2024.

There was mention of delayed hardware deliveries which were expected to be with customers in December but have now moved into Q1 2024.

ONE said that the impact of the delays on the company's 2023 financials would be ~€2.9m (A$4.7m) - guidance by ONE now is for total revenue for 2023 to be ~€9.3m (A$15.1m) for the full year 2023.

ONE expects to recognise the ~€2.9m in revenues in H1 2024.

What’s next for ONE?

- Contract more beds - we want to see ONE hit 25,000 beds in 2024 at the moment, ONE has just over 16,000 beds contracted.

- Sign more deals with new hospitals - We think the Baxter partnership could be a game changer for ONE, especially considering it has a large share of the current hospital bed market in the US. The partnership was launched on the 6th of November so we should know throughout the year whether or not the partnership delivers for ONE.

- Progress on the BYOD product - The BYOD product could be the real scale opportunity for ONE given it reduces friction and quicker to rollout into new hospitals. We will be watching to see if ONE can get new deals over the line for the new product.

What do the analysts think of ONE’s progress?

An MST access research note published two days ago places a 63c per share valuation on ONE, against a current share price of 24c:

(Source - Read the full January 2024 MST ONE research report here)

While that price target does look interesting, we should be clear that analyst price targets are based on a number of assumptions that may be incorrect - they (or us) don't have a crystal ball. It’s definitely possible ONE does not reach these share prices. This is a small cap tech stock. Never invest on a price target alone, and always do your own research.

What could go wrong?

Sales risk

Despite a strong customer retention rate and the endorsement of the product by prestigious hospitals, ONE could lose key clients or not seal as many deals, hurting their revenue and share price.

Large institutions like hospitals don’t tend to adopt new technology very often and the sales cycle can be long. This feature of ONE’s customer base can cause delays in sales that drag out over a long time,

Marco factors in the market including a recession can cause a reduction in spending on new technology, affecting ONE’s ability to make sales.

Distribution partner risk

A key part of ONE’s strategy is to sell its products through a distribution partner like Baxter, Microsoft or Samsung.

Although ONE has a strong relationship with these companies, if they move slowly - or don’t prioritise ONE’s products when making a sale - then it could reduce the sales outcomes for ONE.

Funding risk

Although ONE raised $20M in July 2023, growth companies need cash to achieve their goals. If ONE doesn’t use the money from this raise wisely, then share price pain could follow. This was ONE’s fourth capital raise since it listed in 2016. As of the latest quarterly, ONE has a cash balance of ~$18.7M.

Technology risk

ONE will need to add functionality to its products over time as the health tech industry advances. The BYOD rollout may not go as planned.

Also, ONE has flagged that a range of additional features are in the pipeline, and the successful roll out of these features could help it reduce this particular risk as hospitals become more advanced.

Market risk

Tech stocks could fall in value again. Even if ONE does everything right from an operational standpoint, the market could always sell off or favour different sectors.

Our ONE Investment Memo

In our ONE Investment Memo you’ll find:

- Key objectives for ONE

- Why we Invested in ONE

- The key risks to our Investment Thesis

- Our Investment Plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.