#VEGAN: ROO Launches into $27B Plant Based Meat Market

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Major players in the faux meat market, such as Beyond Meat (NASDAQ: BYND), are redefining meat eating experience.

After a highly successful IPO in May, Beyond Meat is currently trading at US$163 per share, with an almost US$10 billion market cap as it goes head to head with the US$1.4 trillion global meat industry.

Beyond Meat’s valuation alone speaks volumes to the growth and acceptance of the industry, as the global population wakes up to the fact that consuming meat is contributing to the destruction of the environment — increasing carbon emissions, water consumption and deforestation.

Another company looking to redefine meat consumption to have a positive environmental effect is Impossible Foods.

Earlier this year, Impossible Foods raised US$300 million to take plant based meat mainstream. The company has raised over US$700 million in total, and is valued at US$2 billion, should it decide to IPO in the near to medium term.

Impossible Foods has attracted several savvy Silicon Valley billionaires, who are lining up to get onto the next wave of billion dollar unicorn plant-based meat companies.

Impossible Foods institutional investors include the likes of Khosla Ventures, Microsoft Corp co-founder Bill Gates, Google Ventures, Horizons Ventures, UBS, Viking Global Investors, Temasek, Sailing Capital, and Open Philanthropy Project.

Yet, it was US burger chain, Burger King that really set the cat amongst the pigeons (or the cow amongst the plant-based patties) when it began testing Impossible Foods’ plant-based burger at locations in St. Louis in April this year.

The move resulted in a strong growth in traffic, leading to the giant burger chain extending the Impossible Whopper to six more markets.

This is a burgeoning trend that is likely to accelerate over the coming years and leading innovators are only beginning to scratch the surface in this industry.

Roots Sustainable Agricultural Technologies Limited (ASX:ROO) is looking at having its own ag-tech influence.

ROO has just begun a planting program to examine the effects of its Root Zone Temperature Optimization (RZTO) and Irrigation by Condensation (IBC) technologies on several protein-laden crops, including peas and beans. The goal is to increase the content of leghemoglobin – also known as “heme” — a form of haemoglobin in plants and the key ingredient in what makes plant-based meats so tasty.

Of interest to current and future investors, is that ROO has already made headway by reporting yield increases of 40% on beans using Roots RZTO technology.

Putting two and two together, ROO is looking to serve up its tech to the agricultural producers supplying to the fake meat market.

How will it do so? To find out, let’s catch up with:

Share price: $0.05

Market cap: $3.4 million

Here’s why I like ROO...

Meeting new ‘meat’ requirements

Israeli-based, Roots Sustainable Agricultural Technologies Ltd. (ASX:ROO) is developing and commercialising disruptive, modular, cutting-edge technologies to address critical problems being faced by agriculture, including plant climate management and the shortage of water for irrigation.

Its focus on climate and water is important to ROO’s growth trajectory: plant-based meat agriculture is fast becoming a multi-billion dollar industry and ROO wants to give growers in this industry a big leg up.

In essence, moving into faux meat market could be quite lucrative for this ASX agtech junior. It could also be a reputational play amongst ethical businesses, the community and investors.

So what exactly is ROO doing?

The company will be planting crops at its research and development hub in central Israel where the leghemoglobin – remember that’s the key ingredient in plant-based meats – content of beans will be measured in a two-part program using ROO’s root zone temperature optimisation (RZTO) technology.

The root zone cooling will be the first thing measured. Following this, the Israeli autumn and winter seasons will play host to a second round of crops tested using root zone heating.

Roots’ Irrigation by Condensation (IBC) technology will then be used to examine the effect on protein content of the ‘deficit irrigation’ concept using irrigation from just humidity in the air.

The results from each plot will be compared with a control plot planted under the same ambient conditions and the results compared.

Positive results will could see ROO influence the anticipated US$27.9 billion demand for plant based meats by 2025.

Huge addressable market

Growing interest in meat replacement crops has accelerated the search for high protein vegetables and technologies that can increase the protein content in any given crop.

ROO can help.

It will essentially feed into a zeitgeist in which the health benefits of plant-based proteins over meat sources is becoming a major social movement.

Ethics around livestock management, and environmental issues are also a key focus of those extolling the virtues of a non-meat based lifestyle.

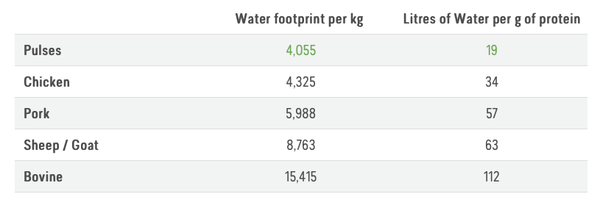

The numbers surrounding this movement are interesting: 1kg of beef requires 15,415 litres of water, whereas production of 1kg of pulses has a water footprint that's 74% lower of just 4,055 litres.

Here’s a look at the water footprint of various meats.

New York Times columnist Timothy Egan writes, “Industrial agriculture to produce meat is the coal-mining of food production. Producing a single beef burger takes about 660 gallons of water — equivalent to a full week of water use by the average household in the United States.”

Essentially, behind the rise of the fake meat revolution is a growing awareness of climate change responsibilities.

This article explains how a plant-based diet can fight climate change:

Meat is still king, but as one kangaroo is saved at a time, so too is the climate.

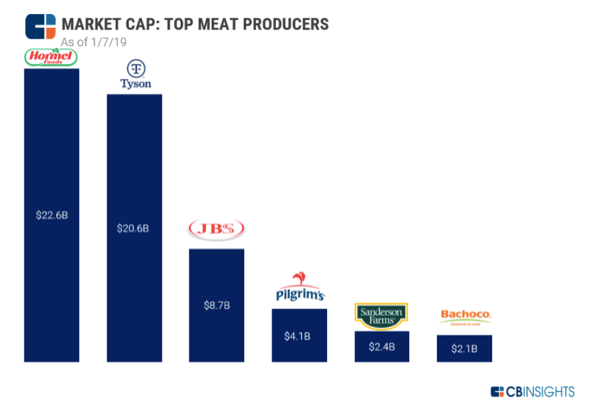

Here’s a look at how powerful the meat industry is in the US alone:

The top six meat companies are worth over US$60 billion combined. However, the monopoly is starting to be challenged.

How heme (and ROO) is helping the climate

Heme is similar in look, preparation style and flavour as beef, but without the environmental impact and negative health effects of real beef.

And it is being used more and more in faux meat products.

This video gives an insight into how Beyond Meat is changing the market:

Beans and peas are examples of crops from which Heme can be extracted.

Roots CEO, Dr Sharon Devir explained that bean and pea protein is becoming more accepted in communities and is rapidly gaining popularity among plant-based meat manufacturers at a global level thanks to its high protein content and health benefits.

Devir said, “With the global demand for plant-based meat to reach US$27.9B by 2025, Roots is positioning itself to address a major market that is surging due to the changing way we eat. Growing concerns about sustainable consumption of animal protein has urged consumers to elect for alternative protein sources, furthering demand for plant-based meat products.”

Leading manufacturers in the global plant-based protein industry have shifted resources to developing common meat products, using pea protein as a base for future product development.

ROO is thus fast-tracking its studies in this field to see how it can help plant growers, whilst having an influence on this growing market segment.

The company expects results from its research planting activities to land in March 2020.

Further activity in the sector

According to CBInsights there are plenty of start-ups using technology to engineer meat or manufacture it from plant-based products. Products can include beef-free burgers to pea-based prawns.

Clearly these companies and the scientists behind the work are set to disrupt the industry.

Here is the world’s first test tube steak.

I don’t need to go any further in explaining the rise of the fake meat industry. You get the point by now.

So if ROO can help heme growers, its agtech solution may be behind the fake burger you’re stuffing hungrily down your throat.

The final word

Now, I’m not one to say ‘give up meat’, I love meat. But it’s certainly worth thinking about the way it is consumed and the amount of meat consumed.

Remember the old ad, ‘I can’t believe it’s not butter’, well it seems we have transcended that and the new form of edible disbelief is directed squarely at the feet of ... meat. Now we have what is affectionately known as fake meat, vegetarian meat, faux meat, or ethical meat.

ROO will finish its tests in March, at which point we’ll have a better understanding of how it can affect the growing meat free product market.

The company is already having an impact in the cannabis space and with basic crops such as tomatoes, so there is no reason to think it can’t have a similar influence with regard to the ‘I can’t believe it’s not meat’ movement.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.