US$3.5M Revenue per Year Guaranteed – MYQ’s New Deal is a Company Maker

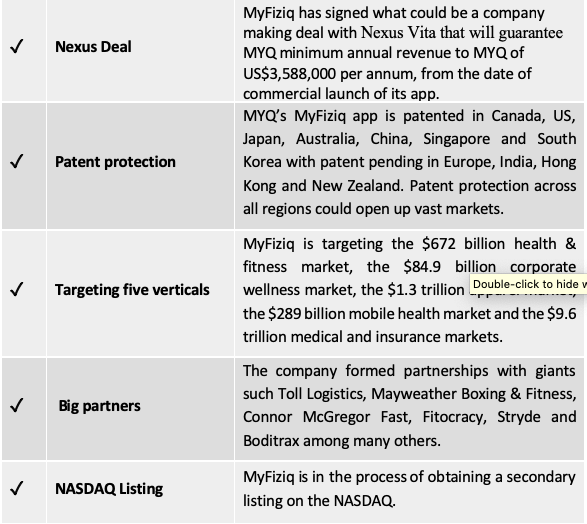

Today, one of our long-term portfolio investments MyFiziq (ASX: MYQ) signed a binding term sheet that will guarantee MYQ minimum annual revenue to MYQ of US$3,588,000 (AU$4.99M) per annum, from the date of commercial launch of its app.

The deal is with Nexus-Vita Singapore, a health monitoring and management technology company that MYQ will work with to release the app in January 2021.

MYQ CEO Vlado Bosanac sees the transaction as a turning point for MyFiziq.

This deal provides MYQ with a clear pathway to not only revenue but potentially profitability, based on current burn rate. Looking at the company’s recent financials, it shows revenue on this deal alone being larger than its previous FY costs.

This comes ahead of the multiple releases and integrations MYQ currently have underway, which are anticipated to generate further top and bottom-line growth.

Commenting on the deal, Bosanac said, “Nexus-Vita is taking advantage of the global need for digital health engagement, which has seen significant increase with individuals reluctant to attend medical facilities and the compounding strain being experienced by the healthcare system worldwide as a result of the current pandemic. Nexus-Vita has identified, developed, and entered the market with a dynamic and well-resourced offering. I am pleased to be working with Jeff and the Nexus-Vita team to provide the CompleteScan platform capabilities to their unique intervention, monitoring and pre-emptive health solution.

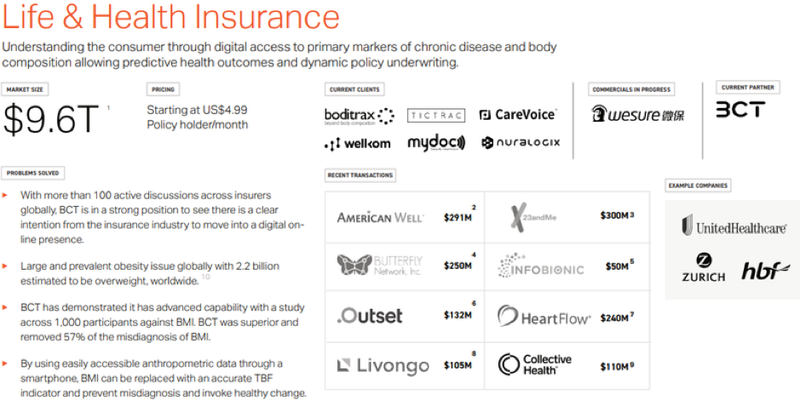

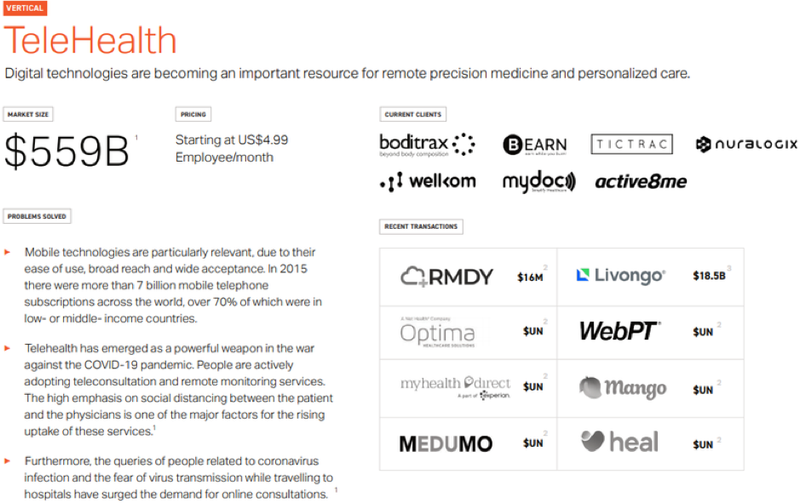

“With the COVID-19 pandemic, the world has experienced a surge in mHealth, telehealth, virtual care and preventative health investment. Nexus-Vita’s user monitoring and engagement-based platform is in good company with recent activities in the digital health, telehealth, and medical sectors, which saw Teledoc, acquire Livongo for USD$18.5 billion. Nexus-Vita is targeting both intervention and early identification of addressable disease prior to current preventative healthcare solutions, which is unique and innovative in this much needed and accepted market segment.”

It’s worth reiterating the Livongo deal Bosanac refers to above. In August, telemedicine provider Teladoc Health reached an agreement to buy diabetes coaching company Livongo for $18.5 billion, in a deal that will create a global true health tech giant.

It is not just health management, but data management also that is having an impact in this current climate.

MYQ is currently capped at $150M – so if it can continue on its pathway, we see significant additional upside from here.

The Livongo deal is one of many in an era in which demand for telehealth and health-tech is surging.

Healthcare is a growing industry. The global health industry was worth $8.45 trillion in 2018. Global healthcare spending could reach over $10 trillion by 2022.

Further to this, the global weight loss and obesity management market is expected to rise to an estimated value of US299.14 billion by 2026 registering a substantial CAGR of 6.70% in the forecast period of 2019-2026.

Companies operating within the data management space are in the box seat to capitalise on this growth.

Brainchip (ASX: BRN) has already done so. BrainChip has developed a computer chip that copies the functions of the human brain to process information or data in an artificially intelligent way.

Last month the tech unicorn raced to a $A1.4BN valuation.

Between 2 September and 9 September, it added around $936 million in value, going from 31¢ to 91¢, on the back of an agreement to offer space-industry player Vorago Technologies early access to its brain-chip named Akida.

Over the past year BRN shares are up 2933 per cent. This is despite the company earning just $US13,397 in revenue from customers in financial 2020 and $US66,635 in financial 2019. For financial 2020 it posted a loss of $US6.86 million

BRN's valuation shows the power a single deal can have on market forces, despite revenues.

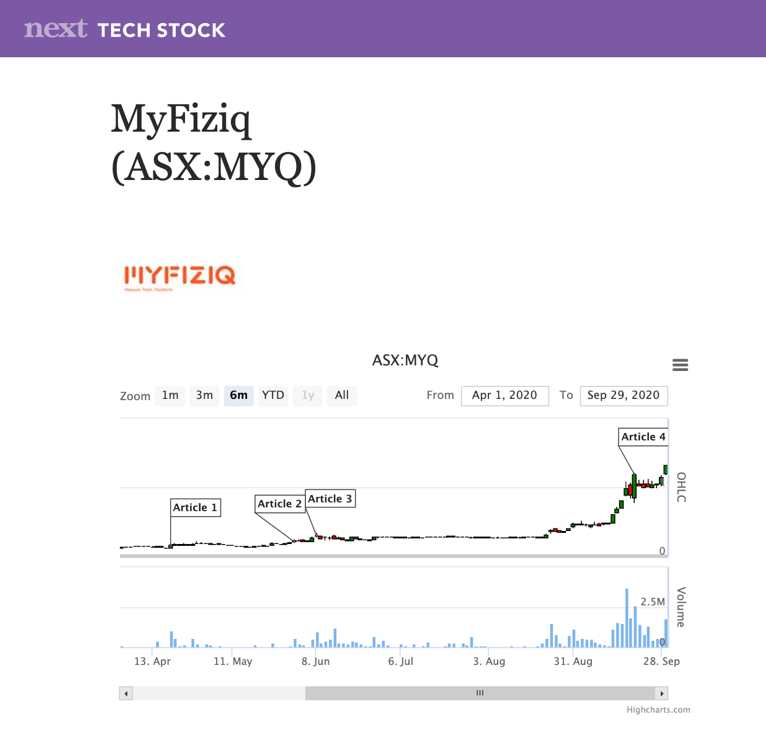

MyFiziq isn't moving as quickly as BRN in valuation, but over the last six months it has performed admirably and the deal with Nexus could be a tell-tale sign of things to come. Remember, this deal brings with it guaranteed annual revenue of US$3.5 million.

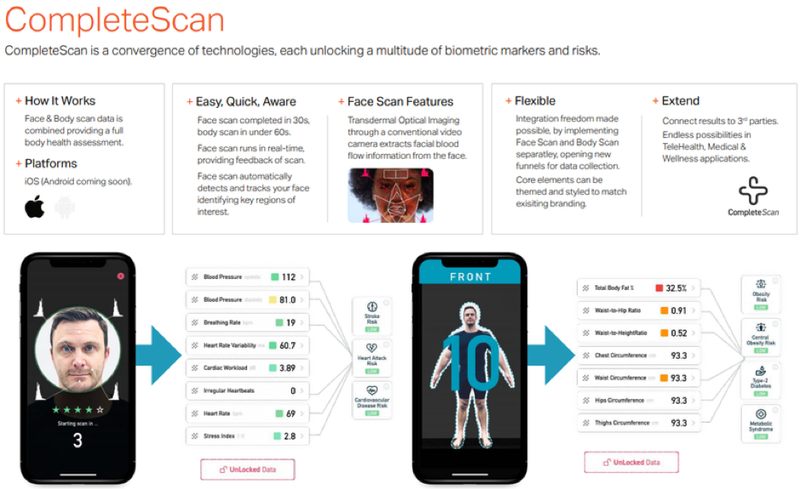

For those who don't know, MyFiziq has developed and patented a proprietary dimensioning technology that enables its users to check, track, and assess their dimension using only a smartphone privately and accurately.

Given its position in the market and potential to roll out its breakthrough technology, we first took a long-term hold in MyFiziq in April this year when it was just 11.5 cents.

Since, then the company has been up 892%.

We expect MYQ to continue its upward trend and today’s announcement does nothing to dissuade that opinion.

The deal that could transform MYQ

Nexus-Vita has developed a medical health and wellness platform that is the bridge between

an individual’s medical health and wellness management with the aim of reducing health costs for individuals, governments and the healthcare and insurance systems across the globe.

Nexus’ application allows individuals to track and manage all facets of their health and health records, perfectly complementing MYQ’s technology.

The Nexus platform uses state of the art record-keeping protocols in a singular digital platform where an individual can save their records and share them with their doctor, personal trainer or lifestyle advisor.

Nexus can drastically improve lifetime health, reduce the need for medical interventions, and save cost and resources for the user and health systems through its partnership with MyFiziq and the use of its CompleteScan technology.

The goal of Nexus is to bring together leading global technologies into a single environment for an individual or organisation to then manage user care and understand their health on an individual basis.

Nexus stores and maintains these records for the individual or organisation, allowing easy access to enable health surveillance and monitoring with the goal being the identification of early health indicators and aggressive pre-emptive care enforcement.

The pre-emptive health platform is to monitor, improve and engage with a user for better quality of life, while also reducing user spending on medical treatment, and tempering interactions with the medical system.

With medical facilities and personnel stretched to their limits globally and further compounded by significant worldwide economic downturn and job losses as a result of the COVID-19 pandemic, Nexus’s solution is designed to improve health outcomes, saving individuals, insurers and government’s substantial costs while also helping to reduce the burden on the global medical facilities and supply chains.

January 2021 set for integration

Nexus and MyFiziq will collaborate to integrate MyFiziq’s body tracking application into all of Nexus’s verticals, commencing with an initial integration into Nexus’s pre-emptive health platform by January 2021.

Under the binding terms sheet, the parties will work together to deliver a market-ready integration into the Nexus platform by the March quarter of 2021.

In parallel with this, the parties have agreed to conclude all formal agreements within 60 days of signing the binding terms sheet.

Under the terms of the agreement, Nexus has undertaken to deliver a minimum of 100,000 active users within the first 12 months of launch.

Nexus and MyFiziq noted recent comments in relation to real-time analysis and data storage by Dr Mussaad M. Al-Razouki in HealthCare’s Cutting Edge who said, “People have become increasingly comfortable wearing fitness trackers, glucose monitors, smartwatches, and other health-monitoring wearables.

“But to truly capture the benefit of the massive amounts of data being collected, real-time analysis may be necessary, and while many wearable devices connect to the cloud directly, others can operate offline.

“Some wearable health monitors can locally analyse pulse data or sleep patterns without connecting to the cloud.

“Doctors can then evaluate patients on the spot and provide on-demand feedback about their health.

“Experts say collecting data from smart wearable devices may prove highly useful in cases of a pandemic, where faster data processing near the source has the potential to be lifesaving.

“GE, for example, uses NVIDIA’s chips in their medical devices to improve data processing at the edge, particularly for artificial intelligence applications.

“But the potential for edge computing in healthcare goes far beyond wearables.”

Many benefits for hospitals

Significant benefits can be achieved through the generation of speedy data processing for remote patient monitoring, inpatient care, and healthcare management for hospitals and clinics.

Doctors and clinicians would be able to offer faster, better care to patients while also adding an additional layer of security to the patient-generated health data (PDHD).

The average hospital bed has upwards of 20 connected devices, generating a considerable amount of data.

Instead of sending confidential data to the cloud where it could be improperly accessed, it would happen closer to the edge.

Edge computing can also assist in using big data, along with artificial intelligence and machine learning capabilities to predict patterns in the spread of deadly diseases.

For example, US-based BlueDot is a geo-fencing software company that is using data from social media, text messages, and other online communications to predict the spread of the novel coronavirus.

Localised data processing prevents a widespread cloud or network failure from impacting data processing and storage.

Even in the event of cloud operations being disrupted, hospitals that have independently operated sensors could maintain functionality.

MyFiziq's cost-effective solution

Commenting on the significant benefits of incorporating MyFiziq’s technologies into its existing platform, Nexus chief executive Dr Stephen Newman said, “A key part of our behavioural change programs, and early intervention strategy involves having the capability to easily understand users and patients risks of chronic disease through body composition changes in a way that is both cost-effective and non-invasive to the user/patient.

“Nexus currently uses in-facility body scanning machines, which adds additional cost to data capture, and requires users to travel to a facility.

“Body scanning is an instrumental part of our solution and assists Nexus in not only understanding a patient, but also allowing a patient to understand their own health on an individual basis.

“Bringing patients into our facilities with a body scanner on a regular basis to capture and track body composition information is inconvenient and time-consuming.”

“Through integrating MyFiziq’s technology into our platform, we now have the capability to more regularly and cost-effectively understand user and patient body composition information as well as their risks of chronic disease in real time, capturing their body scans from the privacy of their own home, significantly broadening our B2B and B2C customer reach.”

A conga line of news

This is huge news for MYQ, however the company hasn’t been sitting on its hands waiting for things to happen.

As we reported in early September, in the article Our Favourite Health Tech Stock Soars to $1.00 on Major Milestone Hits, MYQ has hit several milestones, including an agreement with Bearn LLC targeting over 25 million users, commencing work with Biomorphik and signing its first Binding Term Sheet to expand the newly developed CompleteScan platform capabilities with Asia Pacific corporate wellness platform WellteQ into the $10 trillion global telehealth, corporate wellness and insurance market.

Remember, this company was just 11.5 cents in April when we first took our holding and has since been up 892% and now sits at $1.32 (at time of writing).

With further to deals to come, there looks to be even further upside to come for this $151 million capped company.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.