Roots’ Agtech More Than Doubles Cannabis Dry Flower Yields

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The North American cannabis market, which is yet reach its full potential, is already a major economic force.

A year after legalisation, California alone will post a record US$3.1 billion in licenced sales. There’s also plenty of scope for further growth with the state’s black market estimated to be worth double that figure.

As a result, the Californian cannabis market is highly competitive and licensed growers are looking for any edge that will improve profit margins, from lifting farm yields to help in growing a premium product.

ASX-listed agtech junior, Roots Sustainable Agricultural Technologies Ltd (ASX:ROO) could give growers that edge.

Roots’ agtech solutions help growers of a wide range of crops — including cannabis — to address critical agricultural problems, such as plant climate management and the shortage of water for irrigation.

As announced today, the company’s upgraded Root Zone Temperature Optimisation (RZTO) cooling system has been shown to more than double the dry flower yield in some strains of greenhouse-grown cannabis in Southern California.

Following an initial sale to premium US cannabis producer, Canndescent in May 2019, Roots’ RZTO cooling system was installed by early June in a greenhouse at Canndescent’s facilities in Southern California.

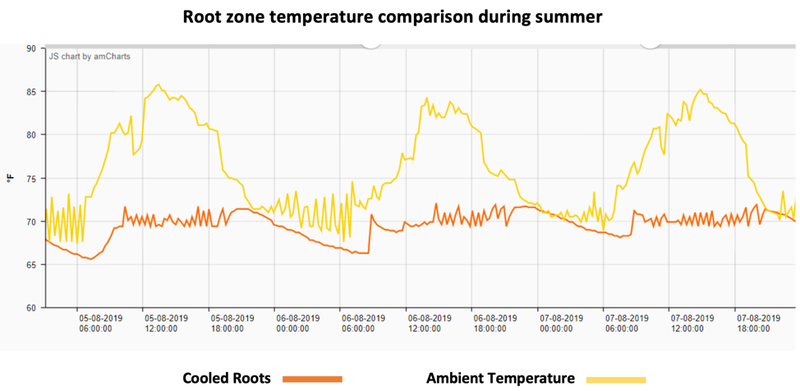

Roots’ upgraded Root Zone Temperature Optimisation (RZTO) cooling system was used to stabilise the roots of cannabis plants at an optimal temperature of 21°C (70°F), despite ambient air temperatures within the greenhouse reaching 30°C (85°F) and outside temperatures topping 43°C (120°F).

This was a major win for Roots — Canndescent has the #1 selling, top shelf cannabis flower in California since 2016.

Today’s result — lifting cannabis dry flowers yields by up to 118% — should translate to an immediate return on Canndescent’s investment and put Roots on California’s thriving cannabis industry map.

This is all part of an aggressive expansion plan that goes hand in hand with other recent news which includes a collaboration with ClearVue Technologies (ASX: CPV) on greenhouse opportunities, plus a recent market entrance into Italy with a local agtech company.

Let’s take a more in-depth look at this current flurry of activity...

Share price: 4.8 cents

Market capitalisation: $4.48 million

Here’s why I like ROO...

Heightened activity

It’s been two weeks since I last updated you on Roots Sustainable Agricultural Technologies Ltd (ASX:ROO). At the time I speculated there could be more news on the horizon. Since then, Roots has certainly delivered.

In a significant outcome for the company, Roots announced today that premium US cannabis producer Canndescent’s May 2019 purchase of Roots’ RZTO cooling system has delivered exceptional results, more than doubling dry-flower yields in some strains.

Prior to that, ROO announced that it had signed a collaboration agreement with ClearVue Technologies Ltd (ASX: CPV) — which has developed advanced glass technology capable of generating electricity — to explore complementary sales opportunities within the growing greenhouse sector.

ROO has also recently signed a Letter of Intent (LoI) with Italian agricultural company Cairo & Doutcher to explore RZTO distribution opportunities in Italy.

That was just in October.

Prior to this month, Roots announced that it had received an initial order from Israeli cannabis producer Univo Pharmaceuticals for thousands of its heat exchange T-shaped stubs, and that it is entering the lucrative plant-based ‘meat’ market. I covered those events, and more, in my last update, ROO Delivers Breakthrough Sale for New Cannabis Technology.

Today, we will first focus on how Roots is California dreamin’.

Roots’ cannabis greenhouse yields by up to 118%

ROO’s RZTO cooling technology has been shown to increase the yield of dry cannabis flowers by up to 118%, compared to uncooled crops from various strains within a climate-controlled greenhouse at Canndescent’s facilities in Southern California.

As stated, the three-year old Canndescent has risen quickly to become the number one selling, top shelf cannabis flower in California, the most competitive market in the world.

Canndesecent is the most expensive cannabis in the USA – so ROO are choosing the right clients to work with.

This could potentially open a lot of doors for Roots. This year Canndescent has launched oils, pre-roll multi-packs, and will launch its first edibles in Q3 and Q4 – suffice to say there is a genuine need for a decent supply of quality cannabis.

You can learn more about Canndesecent in the following video, where company COO Rick Fisher explains the explosive growth:

The RZTO cooling system was used to stabilise cannabis plants’ roots at an optimal temperature of 21°C (70°F), despite ambient air temperatures within the greenhouse reaching 30°C (85°F) and outside temperatures topping 43°C (120°F).

Results of 30% and 188% increase were achieved on two cannabis strains of 400 and 200 plants (equally cooled and uncooled), respectively, within a climate-controlled greenhouse utilising wet mattresses and fans with growing taking place throughout the US summer.

These results follow an initial sale to premium cannabis producer Canndescent in May with the installation completed in early June 2019. But that sale was not ROO’s first sale into the US cannabis market...

The first sale was to cannabis industry leader Tim Blake and was the result of Roots’ Technology Showcase in North America in February and a successful open field RZTO heating pilot cannabis in Washington State.

ROO’s second sale of its RZTO heating and cooling system in the USA was to independent cannabis producer Mendocino Natural Farms in Northern California. That was followed by a sale to large organic cannabis producer, Private Reserve Originals, involving the installation of Roots’ RZTO in growbags and pots within hoop houses of varying sizes.

Yet the California play is just one part of a global expansion strategy.

Roots and ClearVue to collaborate on greenhouse opportunities

Earlier this week, Roots announced that it was partnering with ClearVue Technologies Ltd (ASX: CPV) in a collaboration agreement to explore complementary sales opportunities within the growing greenhouse sector, including the construction of a world-first demonstration greenhouse in Israel.

ClearVue Technologies is an Australian technology company that operates in the Building Integrated Photovoltaic (BPIV) sector, which involves the integration of solar technology into building surfaces, specifically glass and building façades, to provide renewable energy.

ClearVue has developed advanced glass technology to preserve glass transparency and maintain building aesthetics while generating electricity. The technology can be used in the building and construction and agricultural industries, amongst others.

Under the agreement, ROO, together with ClearVue, will pursue sales opportunities with new and existing clients, leveraging each other’s industry-leading technologies to offer a unique combined offering within the greenhouse market.

The pair plan to build a demonstration greenhouse using ClearVue’s energy generating PV solar glazing glass panels to explore powering ROO’ RZTO and Irrigation by Condensation (IBC) technologies.

ClearVue’s PV clear glass solar glazing solution for greenhouses utilises multi-glazed IGU panels to stabilise the air environment as well as generate enough power to operate Roots’ RZTO technology.

The self-sustaining greenhouse, which is intended to be off-grid, will be designed, developed and constructed at Roots’ research hub in Israel and will be available to both parties for customer demonstrations and display purposes.

Roots plan to use the greenhouse year-round to conduct RZTO and IBC testing on various crops and plants. Construction on the demonstration greenhouse will commence as soon as possible and is expected to be completed within 12 months.

This agreement will help also boost ROO’s reach into off-grid agriculture, as the solar powered windows will provide power for RZTO possibly for IBC too.

In addition to the greenhouse, Roots and ClearVue have agreed to work together where possible to deploy Roots’ RTZO technology into all, or a part of, the Cooperative Research Centres Program (CRC-P) grant supported greenhouse that ClearVue is currently progressing at Murdoch University in Western Australia.

The following Finfeed article summarises the announcement:

In its hat-trick of news this month, Roots has proved that it really is looking at global opportunities. North America, Israel and now Italy are all on the company’s radar.

Roots enters Italy with a signed LOI with local ag-tech leader

Earlier this month, on 8 October, ROO signed a 12-month Letter of Intent (LOI) with a leading Italian ag-tech producer and nursery, Cairo & Doutcher, to install a commercial demonstration utilising ROO’s patented RZTO technology and explore distribution opportunities.

Under the LOI, Roots will install its hybrid ground source heat exchange system combined with a heat pump to improve crop quality and increase yields for herbs and flowers at Cairo & Doutcher’s growing facilities in Southern Italy.

Cairo & Doutcher is an early adopter of agricultural technology, utilising innovative cultivation techniques to improve the quality of its pomegranate, mango, avocado, herb and flower crops. The company’s commercial nursery facility also supplies its seedlings, graftings and cutting varieties to wholesale growers.

If the demonstration is successful, the two parties will look to collaborate on an exclusive multi-year distribution agreement in Italy.

This is important, as Italy is one of the largest agricultural producers in the EU, with the sector accounting for around 2% of Italy’s GDP.

Demonstrating the effectiveness of its root zone technology in local growing conditions is an essential part of the ag-tech sales process and ROO sees this paid commercial demonstration — with a respected market leader — to be an important first step towards expanding its global footprint into the Italian market.

Most of Italy’s producers are family run farms of around 10 hectares, so ROO’s climate management technology is perfect for enabling these growers to increase yields and crop quality, increase the number of growing cycles and improve overall profitability year-round.

The RZTO technology doesn’t use air heating and cooling systems, which require high energy consumption, so it cost-effectively maintains root temperatures at optimal ranges. This is ideal for helping growers manage Italy’s varying climate systems.

A final word

With news continuing to come in thick and fast, it can’t be long before investors begin to recognise the opportunity on offer. With a sub-$5 million market cap and share price of less than 5 cps, there appears to be plenty of upside on offer here. Of course, that’s not to say it is without risk, but Roots does seem to be hitting all the right notes.

I also like that its operations and deals are diversified, and that the news continues to roll in. There’s a huge market potential here as ROO’s RZTO technology addresses universal crop production and climate management challenges faced by growers across the world.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.