ROO Chases Plant Based Meat Opportunities Following Key Hire

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

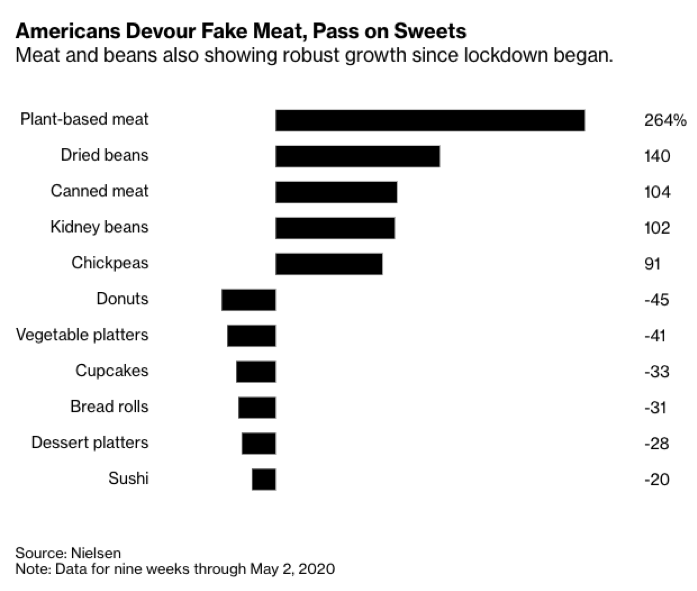

The plant-based meat market was estimated to be worth US$12.1 billion in 2019. It is expected to reach a value of US$27.9 billion by 2025.

The increasing number of plant-based meat consumers can be attributed to growing health concerns associated with the consumption of animal protein-sourced foods and adoption of flexitarian and vegetarian diets for health purposes. COVID-19 is also having an impact with the closure of meat plants due to coronavirus outbreaks.

If you are inclined to listen to plant-based meat experts, it’s not good news for meat eaters.

Impossible Foods Founder and CEO Pat Brown says, “I think people are increasingly aware plant-based products are going to completely replace the animal-based products in the food world within the next 15 years. That’s our mission. That transformation is inevitable.”

Investors are flocking to plant based meat companies on the back of these global trends with entire new markets are being opened up.

Last year, the world’s biggest alternative protein brands, Beyond Meat, the company behind Beyond Burger, IPOd at a valuation of almost $1.5 billion, and is now capped at $7.8 billion.

Beyond Meat will shortly debut its products in select KFC, Pizza Hut and Taco Bell stores in China, making its presence truly global.

Valued at $4 billion as of March 2020, Impossible Foods can be found at chains in the US such as Burger King, Qdoba, White Castle, and Red Robin.

Meanwhile, US companies such as the giant food and agriculture product provider Cargill and US$18.7 billion capped chicken company Tyson Foods are investing in start-ups producing plant-based meat products as they look to boost sales of these products in coming years.

In Australia, the trend has caught on and given rise to companies such as Wide Open Agriculture (ASX: WOA). WOA’s Dirty Clean FoodTM brand offers regeneratively grown animal and plant-based products to Australian and Asian markets. Its food “connects customers to healthy food, grown right; with a clear line of sight from regenerative farm to fork”.

Investors have taken a clear interest in the stock, with WOA going from 13c to as high as $1.85 this month. WOA is currently capped at $102M:

For early stage investors, WOA looks already to have gone on its run, but there are still opportunities in the small cap market for investors looking into the space.

One such company is Roots Sustainable Agriculture Technologies Ltd (ASX:ROO) - a company we have previously covered a few times here at the Next Tech Stock. It has been a long road for ROO investors since its IPO, however it looks like it might have turned the corner if the last week or so is anything to go by.

ROO is valued at just $3.7M, and the company recently raised $2.51M in a placement at 1.6c.

ROO pursues plant based market opportunities

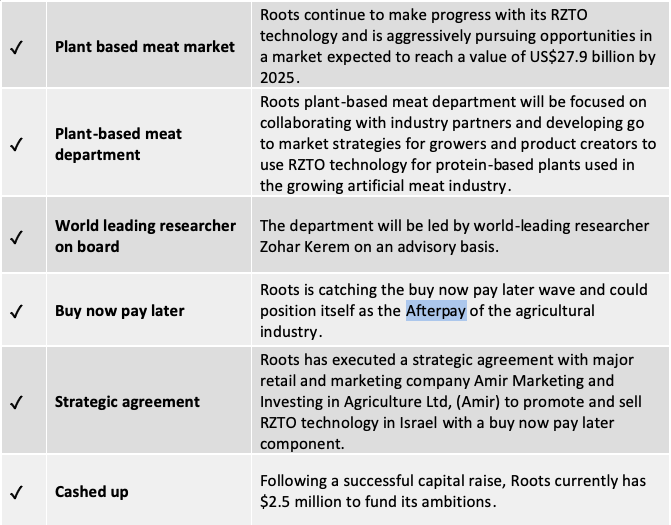

ROO is now aiming to leverage its established agricultural technology into the booming plant based meat market.

The new department will be helmed by world leading researcher Professor Zohar Kerem. Professor Kerem has a long and distinguished career in food chemistry, which we will delve deeper into shortly, and his appointment significantly bolsters ROO’s R&D chops.

ROO is seeking to capitalise on its recent Proof of Concept (POC) study results that show the positive effects Root Zone Temperature Optimisation (RZTO) technology on the yield of protein-based plants.

ROO’s new plant-based meat department will focus on collaboration with industry partners to further commercialise RZTO technology with growers and manufacturers.

Before we look at the opportunities this presents to Roots, let’s quickly recap who they are and what they do.

The Israeli-based agtech company is developing and commercialising disruptive, modular, cutting-edge technologies to address critical problems faced by agriculture today, including plant's climate management and the shortage of water for irrigation.

Roots has developed proprietary know-how and patents to optimise performance and reduce energy consumption to bring maximum benefit to farmers through their two-in-one root zone heating and cooling technology and off the grid irrigation by condensation technology.

The technology is known as Root Zone Temperature Optimization (RZTO) and it optimises plant physiology for increased growth, productivity and quality by stabilising the plant’s root zone temperature and significantly increasing yields and growing cycle planting options, improving quality, mitigating extreme heat and cold stress, all while significantly reducing energy consumption by stabilising and optimising the ROOTS zone temperature.

The Roots plant-based meat department will be focused on collaborating with industry partners and developing go to market strategies for growers and product creators to use RZTO technology for protein-based plants used in the growing artificial meat industry.

Here is why this market is so important:

The department will be led by Kerem on an advisory basis.

Notably, Kerem has been involved with a number of international projects that led to the discovery of new biologically active natural compounds in edible plants, and promoting their use by establishing mechanism of action and designing novel foods; discovery and synthesis of novel antimicrobials for food, agriculture, and cosmetics, and developing novel high protein food products.

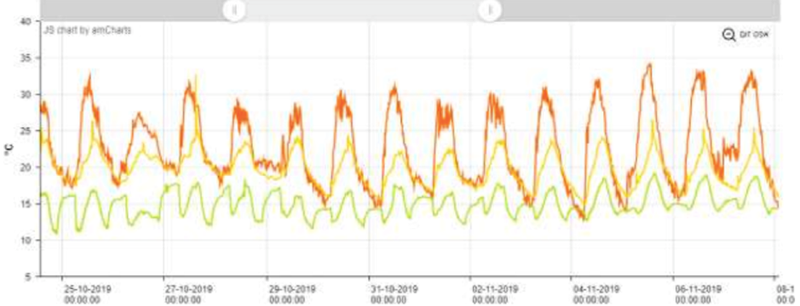

As stated, Roots established the plant-based meat department following encouraging results from a POC study at its R&D facility in Bet Halevi, Israel.

Protocol for the POC was completely organic, using no fertiliser or other chemicals.

During the POC pea and bean plant plants were cooled using RZTO technology, which resulted in a 57% - 67% increase in yield per plant for both peas and beans.

Total pod protein content also increased by 77% and 55% in peas and beans respectively in cooled plants, when compared to uncooled plants.

The results highlight that the RZTO use resulted in weight increase per plant and more pods being generated per plant.

The Company is confident that this will have significant benefits for commercial growers.

The graph below illustrates that while outside measured temperatures peaked at 30°C during the POC, uncooled root zones peaked at 25°C and cooled root zones were never more than 19°C.

Another trial will be conducted shortly using beans and peas for the second stage growing cycle in an open field. During this cycle, the plants will be heated using Roots’ technology through winter.

Having raised $2.5 million recently, Roots now has some runway to capitalise on a number of opportunities through its plant-based meats Department.

“We are extremely excited to have established a plant-based meat department to explore potentially lucrative opportunities in a rapidly growing sector,” Roots Executive Chairman and CEO, Boaz Wachtel said.

“The Company is also pleased to welcome Prof Kerem to lead the division, who will be instrumental in screening opportunities to provide validation of the Company’s technology in enhancing protein in plants.

“We have already achieved excellent POC results using the key ingredients for meat alternative products and we will now commence work to aggressively pursue collaboration agreements and partnerships with manufacturers in the sector.

“As food security continues to becoming an increasing concern for developing and established nations, our broader business performance continues to perform well. The Company has a strong pipeline of opportunities in the agricultural and cannabis sectors and we look forward to updating shareholders on developments in the near term.”

With sales surging in the plant-based meat industry, Roots has picked an opportune time to play its cards.

While the plant-based meat industry is certainly high on Root’s priority list, it isn’t the company’s sole focus.

Roots enters Buy Now Pay Later (BNPL) market

In its attempts to make life as easy as possible for farmers and the agricultural industry in general, Roots is catching the Buy Now Pay Later wave and is aiming to position itself as something of an “Afterpay of the agricultural industry”.

The BNPL market is a multi-trillion dollar industry and like the plant-based meat market could continue its exponential growth.

While the buy now pay later trend is mostly associated with the retail sector, Roots could set the tone in agriculture and create a brand new market of its own.

This week, Roots executed a strategic agreement with major retail and marketing company Amir Marketing and Investing in Agriculture Ltd, (Amir) to promote and sell RZTO technology in Israel.

The difference to most other agreements is that this includes a ‘Buy Now – Pay Later’ component, designed to lower the barriers of entry for farmers and expedite uptake.

Amir sells a wide range of agricultural products and solutions to private farmers and agricultural businesses in Israel and has 25 retail stores and trade centres across all major agricultural areas in the country. The company services approximately 7,500 customers per annum.

Under the agreement, Amir will promote ROO’s RZTO technology in its 25 stores and offer a ‘Buy Now - Pay Later’ plan, which will allow consumers to spread payments for the technology over 12 to 24 months.

Amir will be responsible for cash collections and will make payments to ROO up to 60 days from the signing of a purchase order.

This is one of the first ‘Buy Now - Pay Later’ plans introduced into the agriculture sector and highlights the company’s innovative approach towards business growth.

To further its global reach and drive product demand, Roots is pursuing additional agreements in international target markets with ‘Buy Now - Pay Later’ components as it witnesses increasing demand for its RZTO technology in Israel, as well as in multiple international markets.

The company has an established in-country supply chain which can fulfil any orders from potential customers quickly and efficiently.

“This agreement is a significant milestone for Roots and the agricultural sector more broadly, as it marks one of the first ‘Buy Now – Pay Later’ payment plans for consumers in the space,” Wachtel said.

“The agreement with Amir provides the company with another sales channel into the Israeli market, as well as visibility for our solutions in over 25 retail stores throughout the country at little expense.

“The payment agreement we have struck with Amir will make our technology much more accessible to farmers and other growers throughout Israel as the payment terms align well with farmers’ receivable terms.

“As the world continues to transitions to more ‘Buy Now – Pay Later’ plans for goods and services we will continue to pursue similar agreements with our distribution partners.

‘’We anticipate that this will assist in driving demand for our products in international markets.

The final word

It's been a long road for ROO investors to date, however things might have turned the corner recently.

Roots has number of initiatives underway to drive sales domestically and in international markets where RZTO is being well-received and accepted.

If Roots can achieve success in Israel using ‘Buy Now - Pay Later’ terms, the readily transferable model suggests the company can tailor this type of plan to other countries.

And, if it can further infiltrate the plant-based meat market, it will have caught the wave of two trends that are having a major global economic and social impact.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.