Newly Listed Online Broker Delivers Low Cost P2P Portfolio Construction Tool

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Three million Australians have online broking accounts, with around 700,000 of those being active online traders. Currently the big banks own 75-80% of that business through their platforms — CommSec, nabtrade, and the like.

While these are huge numbers, online broking is still a relatively new service and more and more people are turning to it as an alternative to traditional stock broking and financial advisory avenues.

As the industry matures, investors will have the choice of lower priced and more feature packed broking tools, which could draw them away from the existing bank trading platforms.

The primary benefits of these tools being significantly lower trading costs, and greater control. Trades can be made with the click of a button, rather than needing to call your broker and place an order.

This growing market, along with the need for cheaper and improved service, presents a huge opportunity for switched on, and nimble, FinTech juniors with low overheads to swoop in and pick up a good chunk of market share.

Today’s ASX junior has been operating a CHESS-sponsored online broking platform for two years. It offers an industry leading low flat fee of just $9.50 per trade, regardless of the amount transacted.

That in itself, and the potential growth in investor numbers that it could bring, is enough to consider an investment in the stock. Number expansion could be even higher as it looks to work with traditional financial planning and broking groups to let them use its technology to manage clients’ portfolios.

It should be noted here that this company remains a speculative stock and investors should seek professional financial advice before making an investment decision.

This stock is much more than simply a low-cost online broker. It has a two-tier business model offering portfolio constructions tools to the country’s growing number of self-directed investors with a highly disruptive differentiated technology portal.

The company that we are introducing to you today has something that is unlike anything seen in Australia before — a P2P (peer-to-peer) portfolio construction tool built using actual investment portfolio performances of its users.

What this company is offering isn’t leaving investors to go entirely alone. Its major point of differentiation is its community...and the impressive performance of its user-constructed portfolios.

Today’s company certainly ticks all the boxes: it’s operating in the growing online broking industry, offering industry leading low fees, and a peer-to-peer portfolio construction tool that is the icing on the cake — all led by a savvy and experienced management team with years of experience in the industry.

Yet, there’s good chance you haven’t heard of this company as it only listed on the ASX less than a month ago on November 23. While it’s still flying under the radar for FinTech investors, the company raised $7.3 million during its recent IPO so it can grow user numbers by stepping up its marketing efforts to better broadcast the unique features it offers and the exceptional performance of its user portfolios.

This company is at the cutting edge of integrating artificial intelligence and cloud computing with investing and, as a result, it’s delivering Australian investors much needed solutions.

Introducing,

SelfWealth Limited (ASX:SWF) began trading on the ASX on November 23 — five years after the company first set up operations. It raised $7.3 million via the issue of 37.5 million shares during its IPO, which will be used for marketing purposes to continue to boost the already rapidly rising user numbers.

The company’s IPO was given significant media attention, including the following in the Australian Financial Review (AFR):

Prior to the IPO, the company’s potential was starting to gain significant interest from major banks and financial institutions in the UK and Asia as it was disrupting their comfortable existence. That’s the type of power to transform the industry that this company has.

SWF’s disruptive trading platform is continuing to gain traction and market share with its two product offerings: SelfWealth Trading and SelfWealth Premium.

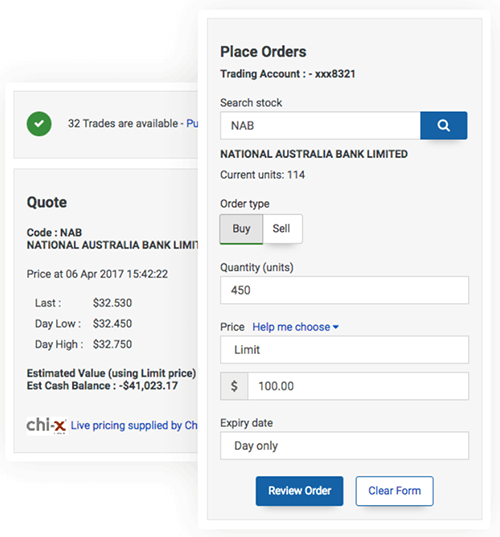

SelfWealth Trading is the company’s proprietary software platform offering a low, $9.50 commission-free flat fee ASX brokerage service, regardless of trade size.

It offers a brand new solution to an age-old investment problem — how to empower investors to make informed decisions without paying exorbitant brokerage fees. SelfWealth monitors 30,000+ portfolios and executes the trades of close to 2,000.

Here you can see the SelfWealth Trading platform, which is available as both an Android and iPhone app.

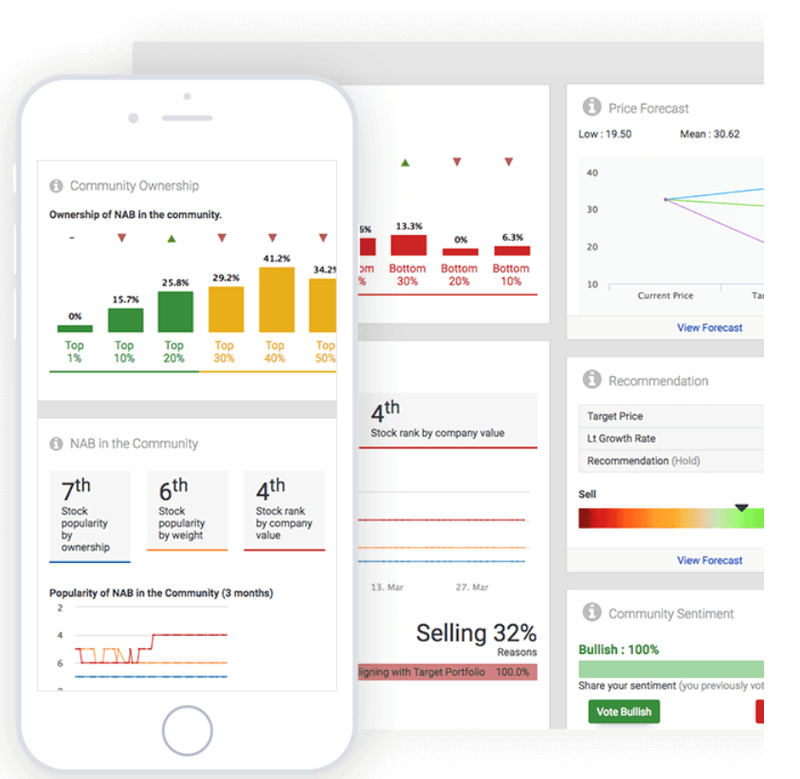

SelfWealth Premium, introduced in 2017, is a social investment network that allows users to compare and construct portfolios with others on the platform — for the first time in Australia.

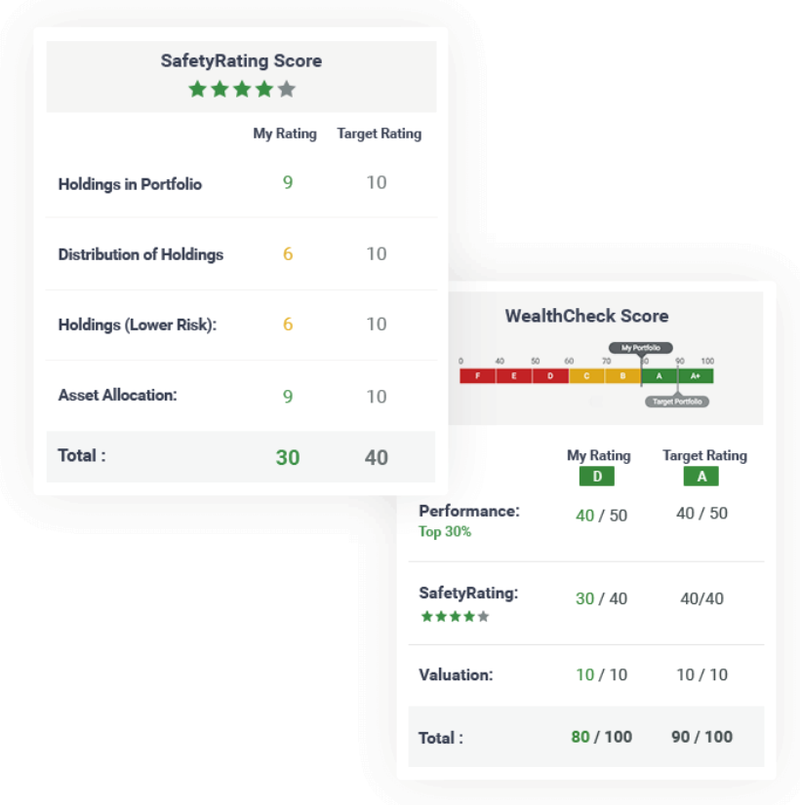

Combining cloud capabilities, the Premium network uses proprietary diagnostic tools to measure investment performance and diversification, providing users with a WealthCheck Score and SafetyRating that can be benchmarked against others on the platform. Each SelfWealth member has an alias, so any shared information is anonymous.

Premium enables users to create their own Target Portfolios, which is a diversified selection of holdings based on the top weighted holdings of the ten best performing members they follow in the SelfWealth Community.

The Alignment Tool compares a user’s current portfolio with their Target Portfolio, and provides the mechanism to execute the required trades to reach the target.

Based on a score out of 40, the SafetyRating measures the diversification of a user’s portfolio to help protect it against the inevitable bumps in each sector of the stock market.

A WealthCheck Score is applied to users’ portfolios. It scores from F to A+ which measures the health of the portfolio against metrics such as performance, SafetyRating and valuation.

Central to the success of its portfolio construction tool is that the company was able to create diagnostics to remove the herd mentality. This leaves users to make investment decisions based on fact not opinion.

The service also includes comprehensive research and reporting tools, providing users with world-class market insights and reporting via SWF’s partnership with Thomson Reuters. This includes recommendations, market news, price forecasts community statistics and sentiments, and more...

SelfWealth Premium is free for the first 90 days of a client’s SelfWealth membership, and then costs $20.00 per month.

The combination of the two services — SelfWealth Trading and SelfWealth Premium — are not only excellent tools for customers of SelfWealth but also for potential investors in the SWF stock itself, as it means the company is not relying on one revenue source alone.

Adding to revenues is the interest earned on clients’ monies held in bank, which is calculated at the RBA cash rate amount plus 0.5% per annum.

The following video provides an overview of the SelfWealth products:

The online tool enables investors to compare the performance of their portfolios against those of their peers, professionals and the market. Users can anonymously follow and track other investors within the SelfWealth community. With the aim to outperform each other, everyone helps everyone and as more people join, the smarter the community gets. This is already paying off in terms of investment performance...

The company created an index of its best performing user portfolios — the SelfWealth 200 (SW200). The index, calculated by FTSE Russell, includes the top 200 holdings by weighting from the top 200 SelfWealth portfolios, rebalanced quarterly. This index outperformed the ASX200 by 47.66% (annualised) from January 2014 - June 30 2017, or 9.14%, to the ASX200’s 6.19% (annualised).

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

SWF is making early strides

While there’s certainly plenty of growth potential ahead for SWF, it is already logging impressive numbers month after month.

On the day it listed on the ASX, November 23, SWF announced that October had been a record month. The company grew its number of active traders to 1690 and reported a compound monthly growth rate of 34% since September 2016. It also executed 4696 trades in the month, for a 29% compounded monthly growth rate.

The company had over $25 million in cash and $232 million in tradeable assets held on HIN (Holder Identification Number on CHESS), which has grown at a compounded monthly growth rate of 33% to end of October.

This was followed up on December 6; SWF again reported that it has recorded continued month-on-month growth across all key performance metrics. It reported continued momentum in its business with a 33% compounded monthly growth rate in active traders.

Actual trades for the month of November were 6312, reflecting a compounded monthly growth rate of 29%. SWF had $281 million in tradeable assets held on HIN and cash, which had grown at a compounded monthly growth rate of 31% to the end of November.

Whether it can continue on this trajectory remains to be seen and investors should take a cautious approach to any investment decision made with regard to this stock.

Note the monthly growth rates in the charts below for the number of trades executed, the number of active trader customers, and the rising value of tradable assets.

While it’s still early days, if growth in tradeable assets continues to grow at anything like the 33% seen in October, SelfWealth will well and truly be on its way towards being a household name...and the go-to online broking platform and portfolio construction tool.

Central to this growth is that SWF’s flat fee has managed to tempt many first-time online traders. Once in the door, these users realise how robust and innovative the surrounding SelfWealth tool is, which leads to ongoing monthly membership revenues.

What SWF has going for it, along with its market beating low fixed brokerage fee, is that it has delivered investment tools unlike any other to Australia. It lets users benchmark themselves against like-minded or top performing investors, allowing them to make investment decisions based on fact not opinion.

SelfWealth is an online community for investors, partnering to achieve the common purpose of better returns. It is a brand-new solution for an age-old investment problem.

Until now self-directed investors have lacked many of the necessary tools to create and manage their own portfolios so that they can take control and avoid paying fund managers.

SWF’s market share is rising as its innovative social network and trading platform continue to gain traction. The result is a testament to SWF’s unique and disruptive offering. Self-directed investors are embracing this new way of trading, particularly the social network that lets them construct and compare investment portfolios.

Australia’s lucrative financial services industry

Australia’s financial services industry is in an extremely lucky position thanks to our compulsory super contributions. This makes the industry extremely lucrative, and fund managers and investment advisors are making the most of it.

According to Richard Denniss, the chief economist of The Australia Institute, “Australians are paying some of the highest prices in the world for what are quite simply basic financial services”.

Australians paid a massive $31 billion in superannuation fees in 2016 says research house, Rainmaker. That is up from $20 billion just three years ago.

The reason that the costs are rising at such a rapid pace is because fees are generally calculated as a percentage of the funds invested. And with compulsory super contributions, the amounts being invested only continue to rise.

While high fees are the norm for fund managers and investment advisors, including traditional stockbrokers, most online brokers also charge a percentage fee, depending on the amount being transacted.

This is where SWF stands out. It has a flat fee for all trades of just $9.50.

As you can see in the table below, the fees rise for all but SWF as the amount transacted is increased.

It’s true that there some other cut price brokers. Take IG Markets for example, it also charges low brokerage for transactions of $10,000 or less, but the difference is in the fine print...

All shares bought through SWF are CHESS sponsored. Being CHESS sponsored means that you legally own the stock, not someone else. The problem with some online brokers is that the client doesn’t own the stock, instead the custodian legally owns it and can on-sell or lend that stock to others to short the market.

This is the case for many other online brokers, including IG Markets. And it is a huge point, one that especially important if we were to again face threats to global banking systems.

Another layer of safety from SWF is that all client monies are held with ANZ, for no fee. That means that deposits are of up to $250,000 each are protected under the Australia Government’s Guarantee Scheme.

There a few reasons why SWF offers a low flat-fee price, even though any good economist knows that offering the lowest price is not always the path to success. Attracting a high volume-low of low margin transaction doesn’t necessarily pay off.

However, in SWF’s case, the low fees bring in more than just a high number of trades. Offering Australia‘s lowest brokerage gets SWF noticed and that translates into rising interest in its other products and services. Namely, its peer-to-peer portfolio construction tool, as well as its EFT offering, plus any new products dreamt up by SWF’s accomplished management team.

So while SWF are pulling in the customers that are attracted by the low brokerage and transparent pricing, it is also exposing them to its unique peer-to-peer portfolio construction tool, which is unlike anything else out there.

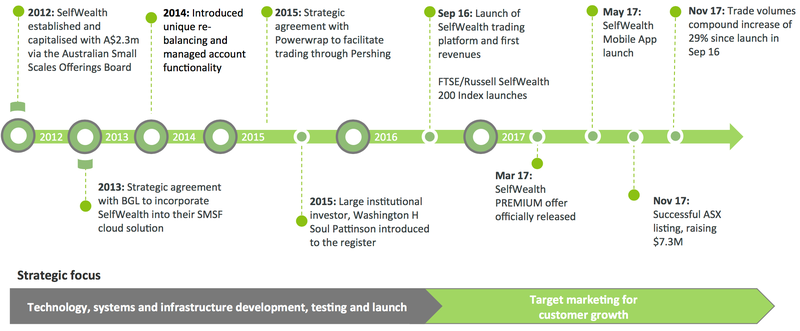

The following timeline details how SWF got to where it is today:

As mentioned earlier, SelfWealth is also considering partnerships with financial planning and traditional broking groups to let them use its technology to manage clients’ portfolios.

It already has a seven-year distribution agreement with BGL Corporate Solutions, Australia’s largest SMSF administration and compliance software provider.

BGL services around 60% of the Australian SMSF market, representing a client base of around 350,000 SMSFs for approximately A$90 billion in assets under management. The agreement enables BGL’s SMSF clients to gain access to SelfWealth Premium.

Note, if considering going down the self-managed super fund path we do urge investors to seek professional financial advice to determine whether this mode of investment suits their requirements.

SWF has also hinted at a possible collaboration with ShareSight — the hugely popular personal portfolio tracking tool, which could integrate very well with SWF’s brokerage platform.

SelfWealth: on track for success

While SWF is still flying under the radar of investors, the company is catching the attention of the industry and stacking up industry awards...

The most recent was Money Magazine ’s Best of the Best 2018 awards:

Amongst its long list of awards, SWF won ‘Fintech Business of the Year’ at the 2016 Optus My Business Awards and was the winner of the Australian Business Awards Software Innovation award for 2016.

Backed by the $7.3 million raised during its IPO, SWF now has the means to communicate the power of its technology to large numbers of potential clients.

Having listed on the ASX only a few months ago, it’s still flying under the radar for FinTech investors, but it is working hard and fast to give it’s ~$18 million market cap a boost.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.