Can ASX AI Solution Transform Multi-Trillion Dollar Financial Services Industry?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Imagine logging onto an insurance provider’s website at any time of the day and being greeted by a Virtual Sales Assistant. Her name is ROSIE and she answers all your questions, providing you with the information you need while gradually guiding you towards the product she has calculated will suit you best. Eventually, she even helps you finalise your purchase.

You didn’t have to wait on hold for 15 minutes, request a call back, visit a store, or complete a ‘contact us’ form on a website.

You got what you needed in real time so you could make a purchase decision with minimal fuss.

There was no extra charge for this service, no matter how many questions you bugged ROSIE with — not that an ‘AI’ Virtual Sales Assistant can get bugged by anything — she is expertly designed to be friendly and helpful with settings that give her, for example, a certain confidence level to answer questions.

Welcome to the future of automated customer sales and service.

You may be thinking this sounds a little like ‘chatbots,’ however ROSIE is so much more. ROSIE is a ‘Cognitive Virtual sales Assistant,’ utilising machine learning to observe and build on her knowledge and she has recently been joined by MAGGIE, a Cognitive Virtual Inquiry Assistant to be used by companies to generate leads from website enquiries.

The company behind ROSIE and MAGGIE debuted on the ASX in November last year following a reverse takeover of an ASX-listed tech company. The company’s aim is to take the complexity out of financial products by making them more accessible to online customers, with the outcome being increased sales conversion rates.

It’s the circle of life for financial services.

The company is already working with a huge Australian insurer — with assets under management of over $200 billion — to launch ROSIE on its platform.

However, it is the US that has been its main focus thus far.

In the US more than $1 trillion is paid in insurance premiums each year and the insurance market itself is said to be worth US$17.7 billion, including 2500 businesses and 176 million consumers.

How much of this market this company can tap into remains to be seen, so investors should seek professional financial advice for further information if considering this stock for their portfolio.

This is just the tip of the iceberg when you look at the overall market and its rapid integration with automation.

Gartner predicts 40% of insurance jobs will be automated by 2026. It’s a premise backed by Insurance Business America :

Furthermore, Gartner estimates that 30% of all customer service interactions will be handled by machines by 2022 and 40% of enterprises will be using virtual assistants by 2019. McKinsey & Company is also on the automation integration bandwagon.

Already today’s company has aligned with big name insurers in the US, as well as a major Australian insurer. It currently has six paying clients that are progressing through a Paid Production Pilot, with one in monthly recurring revenue (MRR) and others close to MRR and Scale.

In a nutshell the company’s revenue model is a simple one: paid trial, monthly subscription fees, and tiered usage fees and revenue share, which we will look at in more detail shortly.

The company may also be looking to increase sales and revenues in Asia, having recently entered the market through MetLife Asia.

It is likely that the financial services sector in Asia, will find the same level of attraction to this company as is occurring in the US and Australia: scalable technology, high level security capability and a first mover advantage in AI.

The company has a $54.3 million market cap and plenty of deals in the pipeline.

That sounds like the perfect time to introduce:

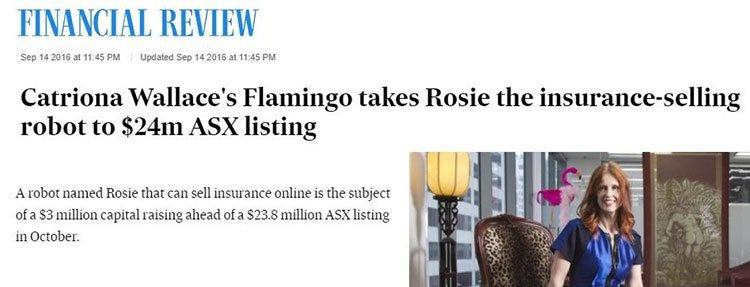

Flamingo initially launched in 2014 to considerable success when it helped the National Australia Bank onboard small to medium businesses. However, instead of focusing its initial pilot on one major client in Australia, Flamingo headed to the US and its huge, AI eager insurance market.

Flamingo made a name for itself in the US, attracting the attention of Fortune 100 companies before returning to Australia and listing on the ASX in November 2016.

Here’s a quick guide to Flamingo as presented by Cre8tek CEO and Flamingo founder Dr Catriona Wallace. Interestingly Cre8tek is the second only woman-led entity, with a female CEO and female Chair, to list on the ASX.

So what makes CR8 and Flamingo so attractive?

The problem CR8 is looking to solve

Through Flamingo, CR8, which has just completed a capital raising of ~$5.1 million to further its services in Australia and the US, believes it has the perfect solution to help financial services companies turn the corner with online sales.

Yet financial services is just the start, CR8 may also soon look at the Healthcare market and further verticals as the company expands its operations.

Big Data analytics is vitally important for making sales, as is online advertising and social media. However, many companies experience low conversion online rates.

Often the customer has questions they need answered to be guided towards a decision. It also explains why several industries are still thriving in terms of face to face transactions, as opposed to online or over the phone — they have the ability to get the information required and build trust in the product.

But call centre and in-store staff are expensive, accounting for huge costs on a company’s balance sheet. Flamingo has created an automated online form that includes human characteristics and can also be used in HAVA mode (Human Assisted Virtual Assistant) — with all the cost savings that entails.

First, give the platform a configurable set of business rules, then add machine learning capabilities (either supervised or unsupervised) and you get ROSIE: a solution to the problem of low online sales conversion rates.

The tech in more detail

ROSIE has been named after none other than Rosie from the much-loved 1960s cartoon The Jetsons . Except this time it has 21 st century applications.

One of ROSIE’s main features is its ‘journey assist’ platform, pre-configured with the key steps in a customer’s journey such as product information, applications, quotation questions, payment gateways, specific to the particular company she is ‘working’ for. This journey will take the customer from researching their product to quotation and all the way through to application and then payment.

This is called ‘narrow AI’ as it’s very specific to this particular scenario and product. As such, ROSIE doesn’t need big data, she can learn on the job from every customer interaction. ROSIE can also be pre-seeded which means pre-trained where she ingests data, eg., questions and answers that a customer might typically engage in, so she knows this before starting out. Flamingo partners with high-profile ASX Listed machine learning company, Appen, who collects the pre-seeding data for ROSIE.

The operator sets ROSIE at a certain ‘confidence’ level which determines at which point she will ping a human being if she is not sure of the correct answer. When this happens, a call centre operator gets alerted, and then engages with the customer and with ROSIE to train her for next time.

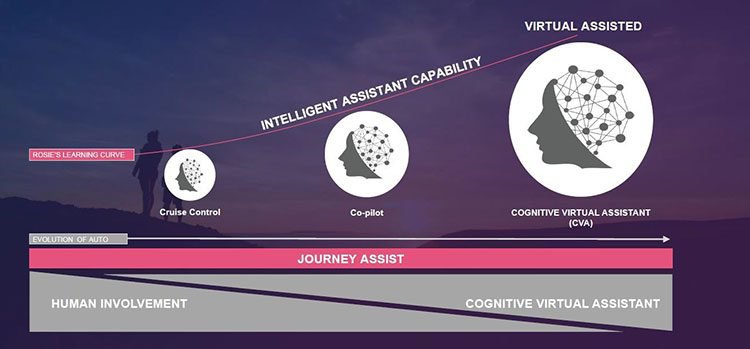

Machine learning automation happens on a curve like this:

Over a short period of time, as you can see, the need for human involvement in the process decreases the more ROSIE is used.

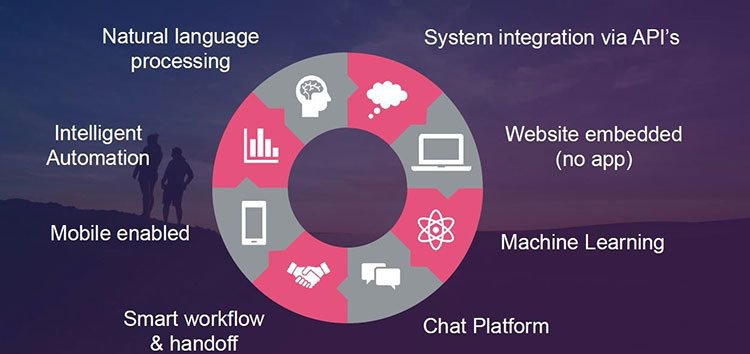

Here are the features of the product that make it highly competitive:

On top of that, she also collects unique data sets that become the property of CR8, to be used for analytics or used to develop out of the box Virtual Assistant products. Thus ROSIE is always building a ‘log’ of information and intelligence. She becomes an expert system in a narrow field.

Here’s an example of how it works from an operator perspective...

And from the customer perspective...

Enter MAGGIE

Joining ROSIE is a second AI/machine learning product, MAGGIE – a Cognitive Virtual Inquiry Assistant.

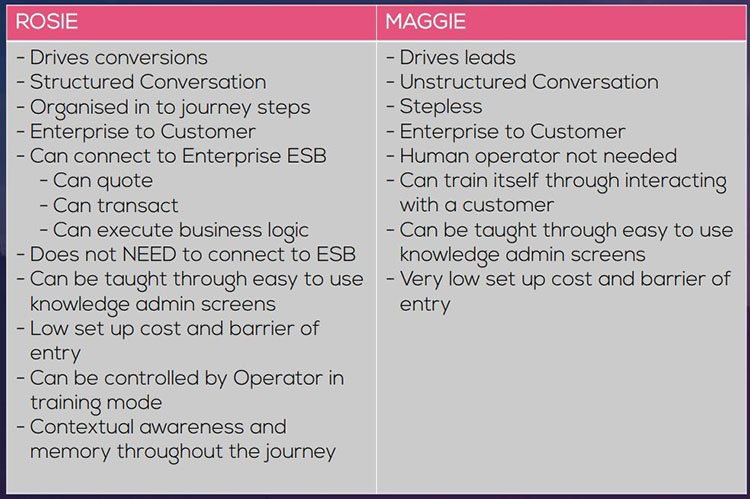

The difference between ROSIE and MAGGIE is that MAGGIE has been developed as a concierge, assisting customers at the point of online contact to the top of the sales pipeline or process.

Essentially MAGGIE is the ‘Engager’ and ROSIE is the ‘CLOSER’.

MAGGIE’s destiny is to appear on client companies’ websites to process FAQs and other information assets. MAGGIE will not only answer questions, but will also guide customers to sales opportunities elsewhere on the websites.

Here are the differences in detail:

MAGGIE complements ROSIE by feeding her sales leads and can be used to replace or augment FAQ functions. It can also monitor messages from Twitter and other communication channels and is suited to companies with complex products and websites.

So with ROSIE and MAGGIE in mind...

How does it make money?

Flamingo has come up with a simple and effective revenue model that’s based on number of interactions customers have with ROSIE.

The more a client company sees would-be customers interact with her, the more Flamingo get in usage fees. That’s on top of a monthly recurring revenue. Additionally, there’s potential for Flamingo to move to revenue share pricing models in the future.

The process goes like this: first, the product is set up in a testing environment on a client’s platform. Next, a trial with live customers is undertaken for a set period of time – a ‘production pilot’ that fully integrates ROSIE into the client platform.

Following the success of the first two steps, clients can switch the platform onto a monthly recurring revenue (MRR) subscription model with tiered usage fees added on top.

Down the track, the company could potentially offer a fourth stage – a revenue sharing model where there will be a performance fee paid to Flamingo for the client’s successful outcomes.

For now the model is quite simple: ROSIE is commissioned for a product and is capped with a certain number of interactions that are included in the MRR. As the client company sees value from the interactions (whether that’s capturing data, delivering more quotes or making more sales), they then drive more traffic to ROSIE, thus increasing their spend with Flamingo.

It’s a flywheel model which is increasingly popular among SaaS companies. Further, the beauty of SaaS is that once the hard work of developing the product has been done, the software licensing fee starts bringing in cash while outgoing costs fall.

There will still be some development though, and new add-on services will attract subsequent fees – yet more income streams for Flamingo.

What the product is really about is the ‘economics of connection’. ROSIE can connect her client companies with their customers in ways that truly affects the bottom line.

And it does affect the bottom line. Here’s a snapshot of some of CR8’s client outcomes so far:

Is this another Siri?

It’s not at all a stretch to draw a comparison between ROSIE and iOS’s Siri technology. But it would be a mistake to consider them the same thing.

ROSIE and Siri represent different types of artificial intelligence. Siri is General Intelligence, meaning she has to know a lot of broad topics, while ROSIE is what is called ‘Narrow AI’. She’s best in very specific situations that require in-depth knowledge of a niche area, such as the insurance industry. ROSIE becomes an expert system, not a generalist.

The Siris and ROSIEs of this world could be working together soon...

For example, if an individual asks Siri to gather insurance quotes. Siri could talk to ROSIE to obtain them, thus excluding the need for human interaction altogether.

This hints at why Flamingo doesn’t see Amazon, Google, or Apple as competitors in the same field... but rather as makers of products that will complement CR8’s in an ‘ecosystem of collaboration’.

Any competitors with products in the ‘narrow AI’ virtual customer assistant space will face a price point challenge, since CR8 have a considerable head start, money in the bank and a promising pipeline of deals with major players that no one can come close to matching.

However, this remains an early stage play and as such any investment decision should be made with caution and professional financial advice should be sought.

A key differentiator – highly regulated industries

ROSIE’s ‘narrow AI’ capabilities are particularly advantageous in highly regulated industries requiring a stringent level of compliance.

Insurance is the obvious example, and CR8 has made plenty of headway breaking into that market already. However, there are several other blue sky areas that could be equally attractive to this small cap as it looks to scale.

It has hinted at migrating into financial services and healthcare. It is predicted that these two industries will be drastically shaken up by automation in the coming years, creating a specific need for exactly this kind of product to help retain or win market share.

The ROSIE product not only improves conversion rates, cuts staffing costs, it can also reduce the incidence of errors in these highly regulated fields and build comprehensive data logs for each organisation making all sorts of processes easier and faster.

Partnerships and production pilots aplenty

CR8 currently has seven major clients including three Fortune 100 companies, one major Australian insurer, an online personal loan provider and MetLife in Singapore.

It has been working with US-based The Clarion Group, Australia-based Deloitte and Asia Pacific based Industrie & Co to keep the pipeline of deal flow bustling.

Most recently, CR8 signed an agreement with another large multi-national insurer, plus obtained a Production Statement of Work (SoW) with US-based Fortune 100 company Nationwide , which relates to the utilisation of the Flamingo platform for one of Nationwide’s products to guide its customers through account set up and self-service.

The SoW also includes a MRR fee for the Virtual Assistant deployment, which could potentially roll out into Nationwide’s other projects.

CR8 is also looking on this arrangement as a key step in entering further agreements with not only Nationwide, but also other existing clients as it looks to quickly achieve a cash flow positive position.

It does, however, remain a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

When a ROSIE outlook meets Blue Sky

CR8 has received plenty of media attention since listing, and it’s no wonder, as we’ve covered above, that this ‘narrow AI’ customer virtual assistant technology looks set to revolutionise multiple industries.

It will be helped greatly in its ambitions after receiving binding commitments for a ~$5.1 million capital raising to introduce new institutional, professional and sophisticated investors.

The funds will be used for product development, account management, sales and business development and general working capital.

Funds will support the implementation of the Flamingo technology in current paid trials, as well as in resource capabilities across Australia and the US to support live clients on a 24/7 basis.

It is expected as client company sales go up, so does CR8’s take of the pie... all with a new ‘light touch’ form of AI that is likely to become as pervasive in business as are call centres.

With robots predicted to take on 40% of US jobs by 2030 , companies can’t afford to ignore the automation revolution.

In the insurance and fintech spaces, the size of the market needing to be served doesn’t look likely to reduce any time soon.

With CR8’s advanced technology, head-start in three key regions, comprehensive revenue modelling, and a high level of demand, could CR8 be set to scale now that it’s listed and cashed up?

It’s leading the way in ‘conversational commerce’, and we’re watching it to evolve from start-up small cap to international AI player in a short timeframe.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.