ASX FinTech’s Blockchain Technology Opens $600BN Remittance Market

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

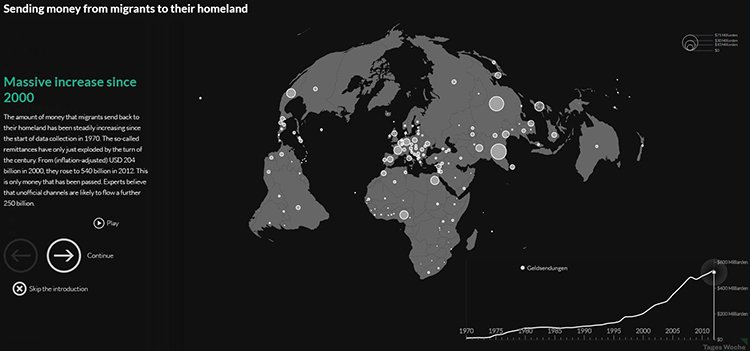

The global remittance market, i.e. the value of payments being sent across international borders, is currently worth nearly $600BN.

However the options available for international money transfers currently range from painful to impossible, especially if you’re after a cheap, instantaneous, uncomplicated, and secure transfer experience, more aligned with the 21 st century way of life.

As the amount of cross border money transfers grow, so too do mobile phone transactions – forecast to hit $1.5 trillion by 2017...

All it takes is for one nimble tech company with the right product to knock existing global money transfer players out of the water.

Today’s revenue generating, ASX listed, tech company wants to do to the sluggish incumbent remittance industry what Skype and Whatsapp did for international phone calls.

This ASX stock has developed an SMS enabled, international payments platform and mobile money transfer product, built on a foundation of blockchain technology.

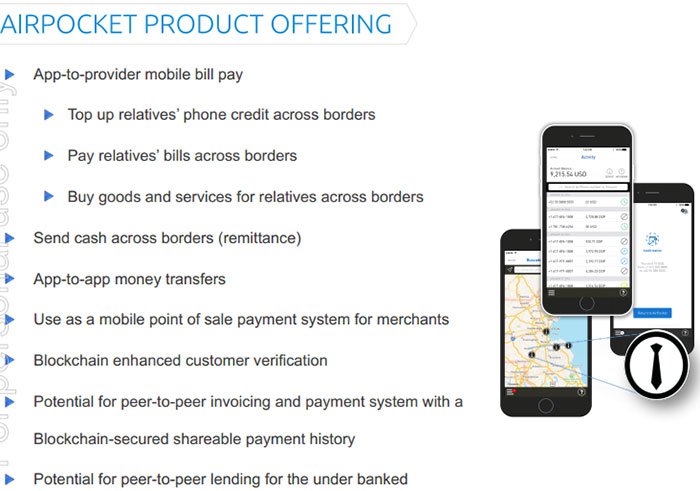

It’s called Airpocket, and it allows anyone to convert physical cash to digital money, which can be redeemed abroad for local currency. It can also be used to pay bills, top up phone credit, and purchase goods and services.

Blockchain technology speeds up the money transfer process, and does it at a more affordable price than traditional players.

If this ASX company can find traction with its product, the opportunity here is a chance to “own” the $600BN international money transfer space...

This company has already launched AirPocket in Latin America, and is set to launch into the Caribbean and Asian markets in the near future. These markets alone represent an opportunity of about $384M, in a global remittance market worth over $601BN in 2015 . To put this market in further perspective, $436BN was received by developing countries.

With the proliferation of smartphones in developing nations, Airpocket can also provide basic banking services to those in remote areas, beyond the commercial reach of the infrastructure of big banks.

And that includes servicing the 2.5 billion people who are unbanked – a vast, as yet untapped market for this company...

It’s common practice for migrants to send money home to relatives living in less prosperous areas and today’s company is looking to make it easier for them to do so. In fact, in the US over half of foreign born Hispanics send money back home to their families.

The company has set up in the United States and Latin America and has been delivering on its partnership strategy.

While Airpocket has only just hit the App stores, the company has already signed up several large commercial partners in the region, including AT&T Mexico, Telefonica, and UniTeller.

This company offers a lower cost to transfer money abroad than existing providers via superior blockchain technology; faster processing time; simplicity of use; and its own proprietary digital customer onboarding and transaction monitoring system.

Importantly, the company has delivered before: their first Blockchain-base product has already produced revenues of over US$38.7M.

And this ASX stock’s market cap? Just AU$12M...

What we have here is an emerging digital payments disruptor, with its foot well and truly in the door of a major opportunity with the US-LatAm migration corridor, having already secured four advantageous partnerships on the road to commercialisation.

Introducing what could be the future of secure digital remittance...

DigitalX Limited (ASX:DCC) is a tech company offering simple, accessible remittance solutions and global digital payments from your phone.

Having made its name (and a solid foundation of technology) in the world of Bitcoin , DCC’s primary purpose now is to build on its Bitcoin experience and create fintech products using blockchain technology – starting with AirPocket, but also with a B2B product, DigitalX Direct, which we will get to shortly.

DCC has signed an agreement with AT&T Mexico to use its AirPocket transfer mobile top up app and has just finalised integration of the two platforms. AT&T has approximately 15% of the Mexican mobile market or 12.4 million users – quite a decent first market entry point for this company.

A partnership with TransferTo for international mobile top-ups also represents a big deal for DCC. TransferTo is the world’s leading B2B mobile payments network and links to 4.5 billion mobile users through partnerships with over 400 mobile operators with reach into over 100 countries.

DCC has also secured a strategic alliance with telecommunications giant Telefónica, completed commercial integration and testing of the AirPocket app on its network, and is marketing the app to its customer base across Latin America. This partnership gives DCC access to Telefónica’s nearly 100 million customers.

The most recent deal struck by DCC was with leading international remittance company UniTeller, and it gives the company access to over 40,000 cash out locations across Latin America and Asia.

As DCC continues to build up its partnerships, the potential for Airpocket to be successful continues to grow.

In order to expand the reach of the Airpocket app and its development, DCC has just completed an oversubscribed capital raising with institutional and sophisticated investors, raising a total of $1.6 million at a price of $0.05 per share.

The new look management team personally contributed approximately $350,000 – which means they can see serious potential here, and have serious skin in the game.

A Share Purchase Plan is happening soon, giving existing shareholders the opportunity to participate in a company capital raise at the same share price as the institutions, which includes a 1:2 attaching option at 8c.

All of the capital raised will go towards marketing through partner channels, the integration of software with various money transfer companies and general working capital, vital to a small cap of this size.

And all of that work only encompasses DCC’s current scope, not taking into consideration future opportunities for expanding or diversifying into other areas.

Being in the buzz-word world of ‘Blockchain’, the possibilities for this company are not only virtual, but virtually endless and include white labelling their product for mobile payments (mobile payments market is expected to reach $2.8 trillion by 2020 ), use of their software for peer to peer lending, and maybe even merchant transactions in underbanked countries.

AirPocket is currently available to top up mobile phones in Argentina, Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Mexico, Nicaragua, Panama, Peru and Uruguay.

Here is a short explainer video on Airpocket, and how it works:

AirPocket is designed to provide consumers the ability to securely and cost-effectively make cross border payments and send remittances in any currency, from anywhere, anytime, regardless of transaction size.

The technology has already caught the attention of global giants AT&T and Telefonica, whose customers can use AirPocket (which we’ll take an in-depth look at shortly) to reach its many millions of customers, but as DCC look to branch out further, its addressable market could grow substantially as it potentially leverages its deals with these telco giants to move into regions beyond Latin America.

Before we have a look at how they might do this, let’s take a step back and establish an oft-heard but rarely understood term: blockchain.

Blockchain is revolutionising online transactions

The basic problem DCC is trying to solve is how to make it as easy, cheap and secure as possible to send money internationally.

Blockchain technology is so called because it is literally a chain of digital records, recorded on a register in blocks. Blockchains are distributed across a database of computers which maintains the growing list of blocks in a decentralised way. As each block contains a timestamp and a link to a previous block, the data cannot be altered retrospectively.

Here is a simple explanation of what blockchain is and how it works.

The technology was first used to create cryptocurrency Bitcoin , where it serves as the public ledger for all transactions with a total current market cap around US$12B. But its use is now broadening to other digital or online applications due to its insusceptibility to fraud and hackers.

A transaction between two parties – let’s say person A pays person B – generates a unique code. That code is then authenticated as genuine by a vast network of computers. Once the code is authenticated, the trade is made and placed on a ledger.

The system is secure because the codes must be deemed authentic by so many different third parties, who all have a complete ledger of every transaction ever completed. This means it’s very difficult, if not impossible, to corrupt.

That’s blockchain in a nutshell, and it’s said that global investment in blockchain-based technology will surpass US$1 billion for 2016 .

Forbes predict it will revolutionise business transactions ; Santander believes it will save banks $20B a year by 2022 , while Australian banks, ASX-listed travel firm Webjet, Microsoft and other companies are at various stages of integrating blockchain technology to make everyday transactions more secure .

Basically, if you conduct online transactions with any kind of tech-savviness, you should probably have a blockchain plan in the works – and DCC is well on top of this.

A little bit of this and a little Bitcoin of that...

DCC made its start in the Bitcoin world through their DigitalX Direct product .

The simple description of the product is it enables developers to integrate Bitcoin sales and purchases into their apps, providing greater liquidity of the cryptocurrency.

The company also made money mining Bitcoins – which is the process of adding transaction records to Bitcoin’s public ledger (or blockchain) of past transactions. The company’s Chief of Technology, Mike Segal, a renowned expert in cryptography and machine learning, even co-founded the first weekly Bitcoin discussion group in the world.

So with a first mover background in blockchain technology, DCC is currently transitioning into the world of international remittances via Airpocket.

Whether the company can do this profitably or not still remains to be seen and investors should take a cautious approach when considering this stock for their portfolio.

Total remittances in 2014 – $583 billion

The total value of remittance payments in 2014 – from migrants across the globe to their friends or family back home – was more than three times the official development assistance funds (aka world aid). And according to projections, about $436 billion of these remittances went to developing countries .

That same year, the average cost of sending a $200 remittance internationally was 8 per cent of the value of the transaction – a significant chunk for each time money was sent.

The ability to offer lower costs for this customer base has been stymied by a few factors – a monopoly on the market from a small group of big players (Western Union, Moneygram and Xoom), as well as legal burdens relating to money laundering and terrorism funding.

DCC has completed its due diligence and spent the dollars on legal and compliance to make sure it’s in line with regulations and to keep everything as secure and legally airtight as possible. Now it’s time to open the floodgates and provide this technology to users.

On the topic of costs and money spent – DCC has been able to drastically cut down their running costs, as legal fees have diminished (AirPocket is now set up and at commercialisation stage so most of the necessary legal costs have been spent), whilst board cost cutting has saved the company nearly AU$1M per year.

Considering those factors, plus commercial deals quickly accumulating, DCC is hoping to have more revenue than spend in the very near future and is banking on Airpocket to help it achieve this aim.

AirPocket mobile payment app

AirPocket is a mobile app for international remittance payments that provides irrefutable proof of transaction through blockchain technology.

The development team has also built a platform which streamlines customer on-boarding (while meeting Know Your Customer regulations), provides a useful user credit history and transaction history (and the foundations for a credit rating); and utilises the newest technology in anti-money laundering.

Customers that complete their details, scan their documents and pass all checks and sanctions including ‘Politically Exposed Person’ checks, are assigned an AirID on a blockchain, allowing the owner of the ID access irrefutable historic data.

Being based on blockchain technology, AirID offers the full spectrum of security including cryptographic signatures, immutability, and decentralisation.

Only with an AirID can users make international payments from the US using AirPocket.

This functionality could unlock the potential for DCC to move into the provision of basic financial services for underbanked regions by allowing users to selectively share these transaction records with financial institutions.

Once set up with an AirID, users can transfer money internationally through AirPocket.

While the person sending the money requires the App, the receiver just needs the ability to receive an SMS. AirPocket has been made with their customer in mind and acts as a secure conduit for the money transfer. The receiver has the choice of having the funds sent straight to their bank account, or picking up the cash at a convenient location.

There are over 40,000 locations currently offering AirPocket cash pick-ups, including at retail giants like Walmart.

As we mentioned earlier the Airpocket app can also be used to pay bills, top up phone credit and purchase goods and services on behalf of someone else in another country (things that are already being done worldwide at a high frequency, but at a high premium).

Being a cloud-based platform, AirPocket is run at low operating costs too, and it means that the tech is infinitely scalable.

Latin America – a strategic target market for DCC

The US-Mexico corridor is the biggest migration corridor in the world and Latin American born migrants in the US represent the largest international remittance market – so it’s a great place for DCC to launch AirPocket.

Here’s a few stats to put this in perspective:

The average cost of sending $200 to Latin American countries from the US was over 6.14% in Q1 2015 .

That year, 54% of foreign-born Hispanic migrants sent money from the US to their home country. Studies show that the majority of these transactions are cash-based, as most Latin American countries operate predominantly in cash.

So we’ve got the problem, the tech solution and the wide open market... but what about further commercial opportunities?

A major way DCC is getting its ducks in a row early is by striking strategic partnerships on the way to commercialisation. As we briefly touched on earlier, in its (air)pocket, the company has: Telefónica, TransferTo, AT&T Mexico – and the most recent addition to the list, UniTeller.

Let’s take a peek at each of these partnerships individually in more detail.

Telefónica – one of the top 5 largest telecoms in the world

The first major partnership announced by DCC was with telecom giant Telefónica, giving them access to 100 million users completing mobile recharge transactions between the US and a selection of LatAm countries.

It’s an early sign of the impressive commercialisation potential in this space... which is obviously the point of DCC setting themselves up in the US-LatAm corridor.

AirPocket testing and technical integration was completed in May this year, and Telefónica marketed the product to their user base through an SMS campaign.

The agreement allows for consumers in the US and Canada to use AirPocket to transfer funds into mobile phone accounts of users on the Telefónica network in Argentina, Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Mexico, Nicaragua, Panama, Peru and Uruguay.

The announcement of the Telefónica deal coincided with AirPocket’s launch on Google Play and Apple’s App store in the US during the same month.

Of course, DCC will be taking a clip of these transactions, so the profit margin could prove highly lucrative.

TransferTo deal on international mobile top-ups

An agreement between AirPocket and TransferTo was announced by the company in September – while you may not have heard of this company, it’s actually the leading global provider of Airtime coverage.

Airtime is the most economical way to send small amounts of money internationally, in real time to recharge mobile phone data, calls and text. This agreement provides AirPocket access for all major telecom carrier coverage across Latin America.

This access spans over 100 countries, allowing access to 4.5 billion prepaid mobile phone users – in a market (the international airtime market) which in emerging countries is estimated to reach US$4 billion in 2017.

The integration of the AirPocket app into TransferTo’s network is a huge opportunity not just for profits but for marketing the product to as wide an audience as possible.

AT&T Mexico – a key to the Mexico-US migration market

The most recent top tier telco to sign up with AirPocket is AT&T Mexico – a subsidiary of AT&T Inc., the world’s largest telecommunications company by revenue.

As we touched on earlier, the Mexico-US migration corridor is the biggest in the world. Penetrating this market will no doubt be a vital component of DCC’s plan to leverage AirPocket’s remittance capability in future.

The agreement allows US consumers to use the app to transfer mobile top-ups into mobile phone accounts on AT&T’s Mexican network (which is currently around 12.4 million users).

As with the other two deals, DCC will earn commission on the value of the transactions – and concurrently use the opportunity to get AirPocket in front of new potential customers.

UniTeller – a leading international remittance company

Recently, DCC announced their new agreement with UniTeller, a leading company in the international remittance space, which will allow AirPocket to process remittances to over 40,000 cash out locations across LatAm and Asia. It will also provide AirPocket with Money Transmitter Licenses across 44 states in the US.

The initial focus of the partnership will be on the US to Mexico corridor; in Mexico alone, UniTeller have 17,000 cash out locations.

UniTeller is a subsidiary of Grupo Financiero Banorte, one of the four largest commercial banks in Mexico, as well as the country’s largest retirement fund administrator.

Addressing the unbanked and underbanked markets

Regions with large populations of unbanked or underbanked citizens, such as Latin America, offer an enormous opportunity for fintechs.

Companies like DCC are creating products that may only represent the tip of the iceberg of what’s to come – but that’s exactly the place to be for a company wanting to be well placed for future growth.

According to a report titled ‘ Half the world is unbanked ’ (by the Financial Access Initiative and Innovations for Poverty Action) 2.5 billion adults worldwide – or just over half of the world’s adult population – do not use formal financial services to save or borrow money.

Of those living in Asia, Africa, Latin America and the Middle East, about 62% of adults (close to 2.2 billion) find themselves in this ‘unbanked’ boat. That statistic is shocking for those of us in the western world who take access to financial services for granted.

Another statistic to bring some perspective to this problem – the report found that a little over 800 million adults who did have access to formal or semi-formal financial services were living on less than $5 a day.

For these regions, gaining access to money (through international remittances) and to financial services (such as online bank accounts, ETFs and credit ratings) in general will go a long way towards improving quality of life.

Honing in on Latin America specifically, some 65% of adults currently have no access to financial services – that’s around 250 million potential new users for companies like DCC.

This combination of need plus innovative tech solution could see a nimble, cost-effective app solution like DCC’s AirPocket really take off – which in the process could make the company and its investors a solid return.

Costs per install

But to see Airpocket really succeed, a mass uptake of users is required – and that needs some clever marketing.

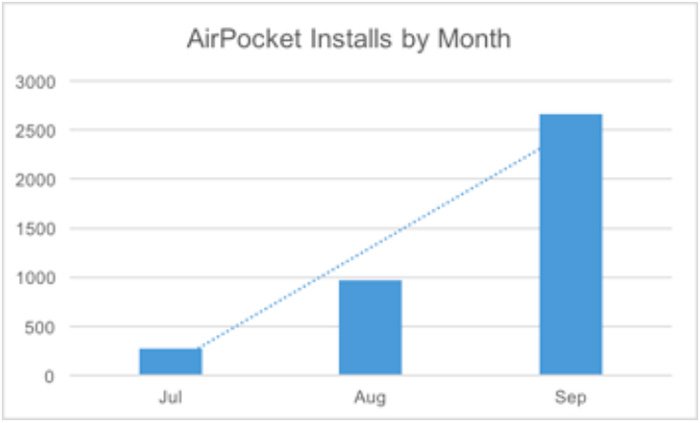

AirPocket is out there and ready for uptake by consumers already, so DCC has some stats on how the CPI – or costs per app install – are going.

Since inception, total marketing spend has resulted in an average CPI of $6.81 USD.

In the last few months, however, AirPocket’s CPI has been trending lower and currently hovers at around US$3.50 per install.

At the same time, downloads have gone up:

These stats speak for themselves in terms of the prospects for future possibility in the near and long term.

As digital marketing spends reduce, we would also expect word of mouth, organic referrals to start boosting download rates.

Future steps and diversification prospects

DCC has hinted at branching its AirPocket and AirAgent technologies into peer-to-peer lending in underbanked regions, which could include a secure and simplified invoicing and payment system.

While building on the advancements of blockchain technology, the company is also borrowing from the burgeoning p2p (peer-to-peer) sharing economy that the likes of Uber and AirBnB are likewise profiting from.

Having the flexibility of a fintech play, DCC has made sure there are plenty of areas it can expand into once it has established its core AirPocket product and once all key partnerships with organisations such as telcos, banks and remittance companies are in place.

DCC has also hinted at white labelling prospects for its AirID blockchain identification platform – which could see it branch into personal banking, auditing, data transmission, information hashing, accounts settlement and more... for residents of underbanked countries, AirPocket can be used to build an official credit history, opening the way for financial inclusion.

Another potential use for this technology is for merchants in Latin America who want to offer cashless transactions – something which would go some way to spring boarding these regions into the 21 st century with little set-up costs.

Will DCC gain ground in the global fintech field?

To put it simply – the technologies DCC is building are versatile, and open the way for opportunities we can’t yet imagine.

Blockchain in general certainly seems to be the system of choice for a new era of online financing, and with a quick re-visit of the benefits outlined earlier in this article, it’s not hard to see why that’s the case.

With a growing pile of big ticket partnerships, an excellent product tailored to a currently unserved customer base numbering in the millions, and a solid tech background in Blockchain and Bitcoin to bolster its collective wisdom, DCC certainly sounds like it may be on its way to big things...

Whether its current key offering, AirPocket, will become the app of choice for international remittance or mobile top-up payments remains to be seen, so investors should seek professional financial advice before making an investment decision with regard to this stock.

The question is: could DCC become the ‘best of breed’ in this multi-billion dollar global market?

At Next Tech Stock , we intend to keep one eye firmly on this dynamic tech play, especially as DCC roll out their product and forge real world results of their three commercialisation agreements.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.