The "Wait and Hold" investment strategy

Published 16-SEP-2023 13:00 P.M.

|

12 minute read

It was a VERY green Friday across our portfolio and watchlist...

For the first time in a long time.

And we saw a few small caps out there in the market deliver sustained 200% price rises during the week, on large volumes.

These kind of price rises can happen from low bear market bases, when small cap market sentiment quickly turns.

After what seems like an eternity of writing (every weekend) about how bad the small cap market currently is, could this finally be the first week of the cycle back upwards?

It’s too early to call, and only a couple of stocks out there have had a material re-rate, but it was certainly great to see some life back into small caps and money finally coming back in off the sidelines.

This Monday, we will be announcing our new Investment.

Our New Portfolio Addition to be Announced on Monday 18th September ~10AM AEST

The small cap market has been rough for ages - remember how good it was back in 2021?

In particular it has been tough for companies that ran out of cash and needed to raise capital at bombed out share prices.

But with so many small cap companies oversold, we think that this has presented an opportunity for “bargain hunting” in anticipation that the bear market will eventually turn back into a bull market (it eventually always does).

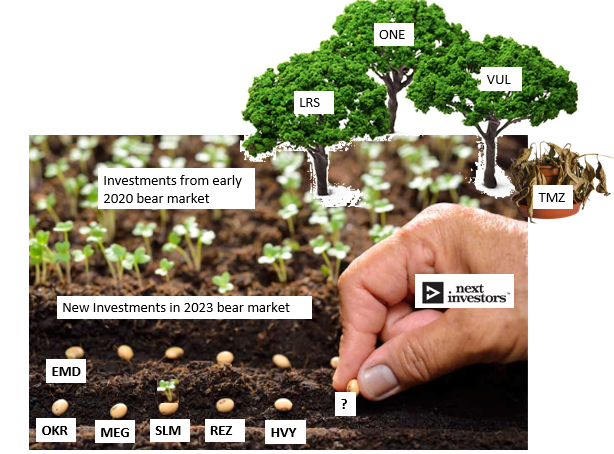

So we have been busy over the last 6 months adding new “bear market” Investments while market conditions (and share prices) are terrible.

Like we did during the market crash of 2020, the plan is to hold on and wait for the market to cycle back to normal, or even bull conditions, and share prices re-inflate back to more normalised valuations.

Over the last few weeks (and especially on Friday) we started to see some green shoots in the small cap market for the first time in a long time.

We have always been optimistic about the long term future of small cap stocks in Australia and see the medium term fluctuations in sentiment as chances to make new Investments while share prices are down.

Since the start of the year we have been on the lookout for new Investment opportunities, what we have been calling our “2023 bear market planting season”.

We review over 400 opportunities each year, and generally only make ~10 new investments.

At its core, we are looking for companies that we think can deliver meaningful returns, 1,000%+ in the long term - and we are extremely selective about each investment we make.

This next Portfolio addition is one we think has the potential to deliver a return of this size (we will also outline the risks we have identified and accepted, and what could go wrong).

Our new Portfolio addition will be announced Monday morning (18th September) at around 10AM AEST.

To ensure that this email hits your primary inbox and avoids the ‘spam’ filter please respond to this email with a simple “hello”.

Remember that the past performance of our recent portfolio additions does not mean future portfolio additions will perform in a similar way. Small cap stocks are risky investments. There is no guarantee of a successful investment. Only invest what you can afford to lose, and always seek professional financial advice before investing.

Our Investment strategy to try and get 10-baggers

A “10-bagger” is a stock that has risen 10x from where an Investment was made.

They are rare in small cap investing.

Most of the time, small cap stocks try and fail at a project, the share price drops and then try something new.

It’s a high risk sector of the market.

Occasionally... a small cap does manage to deliver a 10x return (this is what we are Investing for).

BUT - it is rare for a stock to deliver a sustained 10x return in one quick price spike.

We have found that a sustained 10x return, and especially the holy grail of a 100x return, is usually delivered over many years of holding.

And it’s certainly NOT a straight line up and to the right.

There are many bumps and share price drops along the way.

The stock may spike on good news, and then come back down for a while.

It may be boring for months (or even years) and then finally another share price rerate upwards occurs as the company delivers more progress, settling higher than its previous temporary price spike.

Then it might even come back down AGAIN for a while - an emotionally exhausting ride for long term holders.

And all this happens against the backdrop of the perpetual small cap market boom-bust cycle.

Long time readers will be familiar with our long term Investment strategy.

Every Investment we make is done with a 5+ year view, the window we think is required for the best chance of hitting a sustained 10x return.

During this time we do try to de-risk positions (Top Slice and Free Carry) if the company has delivered on its business plan and the share price is materially higher than our Initial Entry Price.

But the ultimate goal is to hold a long term, material position for that rare and coveted 10x return.

Companies need time to deliver key catalysts and re-rates in share prices.

Multi-bag wins take time and often happen over a course of years, not weeks or months.

So, what pattern can we see in 10x or even 100x stocks?

We Invest in small cap resources, tech and biotech companies.

Let's start with a successful example of “holding a 100 bagger” in resources first, and the ups and downs along the way.

All ASX investors will have heard of Fortescue Metals Group, the company that minted one of Australia’s richest men.

Back in January 2004, Fortescue had a share price of ~6.5c with a market cap of ~$6.5M.

Now, the company has a market cap of ~$60BN and is one of Australia’s biggest iron ore miners.

Anyone patient and brave enough to hold from 2004 would have returned ~420x, but the share price delivered many ups and downs (and long boring periods) along the way.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Obviously, it’s easy in hindsight to think “if it were us, we would have held all the way”, but the drop in 2008 would have been hard to stomach, not to mention the boring years after it.

There were certainly a few people wishing they had sold before that drop - this is why we think it’s also a good idea to de-risk a little along the way if a price runs on material news.

An example from the technology space:

Everybody has heard of Realestate.com.au...

What everyone doesn't know is that back in the early 2000’s REA Group (the owner of Realestate.com.au) was a micro cap with a market cap of <$5M.

Back in 2001, the group had a share price of ~6c per share...

Now ~20 years later it's one of Australia’s biggest companies and has a market cap of ~$21BN.

Investors who exited after the tech crash in 2001 at <10c would have missed the run up to ~$8 in 2008.

...after which it dropped back to $3.

Then those who exited during the Global Financial Crisis in 2008 at ~$3 would have missed the run to where the company sits now at ~$163 per share.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

An example from the biotech space is Neuren Pharmaceuticals.

Neuren during the COVID crash of March 2020 went from a share price around ~$3 down to ~95c per share.

Skittish investors who don’t like seeing a paper loss may have sold at that COVID low OR into any of the retracements at $1.60 and $3 per share in the run up to ~$15.20 per share.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The above examples in resources, tech and biotech show the long bumpy ride to hold a multi-bagger, including how holding through inevitable market crashes and bear markets can be tough (ie during 2008 or 2020).

A couple of examples from our Portfolio where holding through bad patches worked out well (so far...) are Vulcan Energy Resources (ASX: VUL) and Latin Resources (ASX: LRS), Arovella Therapeutics (ASX: ALA) and Oneview Healthcare (ASX: ONE).

Fortunately, we managed to hold through some of the short term volatility and caught the moves back higher.

There are also plenty of examples in our portfolio where we maybe should have taken some off the table after a share price rise, but we didn't. We are still holding because we believe these stocks can still deliver when the market finally turns again.

Key point being this is the small cap markets and nobody can get it right all the time, but our personal strategy (that works for us) is to hold on through ups and downs for those rare multibaggers.

Not to say there is anything wrong for short term investing and trading, it’s just not what we do in our Portfolio.

If we hadn't been patient we could have missed the run in VUL’s shares price to ~$16 per share, the run in LRS’s share price to 40c, the run in ALA’s share price to ~10c and the run in ONE’s share price to ~32.5c per share.

The past performance of these companies are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

But this “wait and hold” strategy isn’t easy to stomach when share prices come off...

These examples from our portfolio worked out after we held through some share price weakness (again, easy to identify in hindsight).

There are a few examples in our portfolios where share prices spiked on good results (or even expectations of good results), and we are currently holding through a period of price weakness or boring sideways movement.

Over the decades we have been Investing, a thing we see time and time again is how failing to hold through short-term fluctuations means you can never really catch that 5-10x move in a company’s share price.

Especially if a macro theme suddenly becomes popular (hello Uranium and GTR).

At the end of the day we are Investing in companies that carry the highest risk profiles on the ASX. This is our own strategy that has worked for using the past and is certainly not appropriate for everyone.

The companies we Invest in typically have market caps ranging from ~$10-50M and we are backing them hoping they first get into the $100-500M market cap range (5-10x) and then eventually get to $1BN+ market caps.

The risk is that the company never achieves its intended goals, the share price tanks and stays down and we lose a large chunk of our money.

That's why we take a portfolio approach where if one or two of our Investments hit a 10x plus home run then any losses on other Investments are compensated for.

We also have an Investment Strategy that dictates certain milestones where we typically trim our positions to free up cash to place more bets.

Overall, our buy and hold strategy has worked out relatively well for us - albeit with the short term movements in share prices that made us think, “MAYBE we should have sold some”.

But these doubts can evaporate quickly when the market finally comes back.

REMINDER: We will be announcing the next investment in our portfolio on Monday ~10:00AM AEST.

Keep an eye on your inbox.

What we wrote about this week 🧬 🦉 🏹

OKR on the move as Uranium price hits highest in a decade

The uranium spot price hit decade highs earlier this week.

A mix of supply concerns and the potential disruptions to enriched uranium supply out of Russia can only mean good things for our uranium development Investment OKR.

EXR signs data sharing agreement with Santos - Drilling next month

This week EXR signed a data sharing agreement with its $25BN neighbour Santos. EXR is preparing to drill its well on neighbouring ground to Santos in October.

88E Flow Test Approaching - why is next door neighbour up 100%?

88E’s neighbour London listed Pantheon Resources share price is up over 100% in the last month.

We looked at the news Pantheon put out over the last few months and gave our take on what we think it means for 88E.

Critical Minerals and the Commodities "Supercycle"

In this educational article we go through the history of the commodities supercycle and why the demand for critical minerals is here to stay.

Quick Takes 🗣️

PUR research report with a 6.1c price target

IVZ Inching Closer to Drilling Mukuyu-2

TEE presentation on hydrogen/helium projects

PFE Standard lithium commits $1.3B to lithium plant at Smackover

Macro News - What we are reading 📰

Biotech

Oil & Gas

Oil Price Resurgence Has Further to Run After the Saudis Turn the Screw (Bloomberg)

Gold

Macquarie bullish on gold as central banks lift buying (AFR)

Graphite

Graphite market outlook: Five key factors to watch (Fastmarkets)

Lithium

Billionaires v BHP in WA’s lithium power grab (AFR)

Joe Lowry tells us what he REALLY THINKS about everything Lithium (Money of Mine)

Battery Materials

Europe accuses China of flooding EV market, pledges fight (AFR)

Copper

Saudi Arabia Sets Its Sights on a Less Glamourous Source of Wealth (Bloomberg)

Uranium

This time it’s real, insist uranium bulls as it finally passes the post-Fukushima spot price (The Australian)

⏲️ Upcoming potential share price catalysts

Updates this week:

- IVZ: Drilling oil & gas target in Zimbabwe, Mukuyu-2 (Q3, 2023)

- No announcement this week from IVZ but the company did put out a video update on the drilling preparations. See our Quick Take on that news here.

- NHE: Scheduled to drill two targets at its helium project in Tanzania (Q3 2023).

- NHE confirmed that wellpad construction was completed for its first well (Mbelele-1). See the ASX announcement here.

- EXR: Daydream-2 appraisal well, QLD

- EXR signed a data sharing agreement with $25BN Santos this week. See our note on the news here.

- 88E: Flow test well, Alaska (Q4, 2023)

- No news from 88E this week but we did put out a note on the recent ~100% move higher in the company's neighbour’s share price. See our note here.

No material news this week:

- SLM: Assay results from maiden drill program at its Brazilian lithium project

- LYN: Drilling its Bow River nickel-copper-PGE project in WA

- GAL: Drilling at the company’s PGE project in the Norseman region, WA.

- DXB: Interim Analysis of Phase III Clinical Trial on FSGS (March 2024)

- TMR: Maiden JORC resource estimate for its Canadian gold project

- GGE: Drilling for helium in the US (Q4 2023)

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.