NHE leveraged to helium demand growth as AI and microchip companies boom

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 4,166,307 NHE shares and 2,437,037 options, and the Company’s staff own 54,339 NHE shares and 2,000 NHE options at the time of publishing this article. The Company has been engaged by NHE to share our commentary on the progress of our Investment in NHE over time.

Artificial intelligence (AI) is the new global investment wave.

By now you probably have seen or heard about the all knowing AI oracle “ChatGPT”.

Every tech company is now rushing to launch their own AI.

Large scale AI is highly complex and requires extreme amounts of computer processing power.

Computer processing power requires physical computer chips - lots of them.

In the last few weeks, computer chip makers’ share prices are surging on AI chip demand.

But here’s where things get very interesting (and highly relevant to one of our Portfolio companies) - producing computer chips requires helium.

Helium is used to make computer chips because it has certain special properties.

Helium is an “inert” gas (it doesn’t react with other chemicals used in the chipmaking process), and it is great at cooling things down (chip production creates a lot of heat).

Back in November 2022, AI powered chatbot ChatGPT launched and ignited a global AI race.

Google, Apple, Microsoft, Amazon have all launched and/or are planning future AI products.

Again, all this new AI is going to require a LOT of new computer chips.

In the last few weeks, global chipmaker’s shares have surged as investors anticipate spikes in revenue from the sales of new chips for AI.

Computer chip company Nvidia has more than DOUBLED this year and became a US$1 trillion dollar company based on its surge in earnings from the sale of AI chips.

Source: Bloomberg

Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest producer of chips, has also seen its share price rise recently:

Source: Bloomberg

All in all, since the launch of ChatGPT and the dawn of AI entering the public’s imagination, over the last 6 months some of the world's largest chip producers have seen their market caps grow by billions of $.

- NVIDIA’s share price is up ~135%

- AMD’s share price is up ~80%

- TSMC’s share price is up ~25%

- Intel’s share price is up ~20%

Increasing the number of chips produced for AI means an increase in demand for helium.

As they say in a gold rush: “When everyone is looking for gold, it's a good time to be in the pick and shovel business.”

We are at the start of an AI rush.

The chip makers are selling the picks and shovels...

Helium is a key manufacturing ingredient required for the computer chips that are the “picks and shovels” of this new AI rush.

And our helium investment Noble Helium (ASX:NHE) is only a few months away from drilling for potentially the world’s largest reserve...

NHE has a giant unrisked mean prospective helium resource of 176 bcf in Tanzania - which according to NHE is the “best untested helium system on the planet”.

NHE is gearing up to drill two high impact helium exploration wells in Tanzania next quarter. The drill targets have a max combined 16BCF helium potential.

For context on the size of this prize - the current long term bulk wholesale liquid helium pricing is US$450 per mcf - 50 times the price of LNG.

It would be great to see NHE deliver a helium discovery in the midst of an AI chipmaking boom.

Remember though that exploration is risky, and NHE may not make a discovery in their upcoming drilling campaign, which would negatively impact the share price.

Noble Helium

A few weeks back, NHE was just days away from announcing a farm out of their project which would fund their initial drilling campaign and back costs..

At the last minute, NHE decided to go it alone, and raised $13.5M at 18c, with NHE directors investing over $1M of their own cash.

NHE now retains 100% ownership of the project as it drills the first well - meaning current shareholders have exposure to 100% of the upside.

This funding strategy ends up being less dilutive on project ownership for existing NHE shareholders (the ones like us that have been holding prior to the new capital raise).

We put in a bid for ~$100k the day after the placement was announced - but got $0 allocated to us because it was already “heavily oversubscribed and the book had closed last night” - you snooze, you lose.

We still hold every single share in NHE since we first Invested and are looking forward to their initial drilling campaign.

As always, remember that early stage exploration investments like this are high risk. The company is in the ‘pre-discovery’ phase and is not making any money - so it's reliant on capital markets or future farm in partners to fund further exploration efforts. There is no guarantee it will make a discovery. If the drill result doesn’t meet or exceed market expectations the share price will likely go down (see end of this note for key risks).

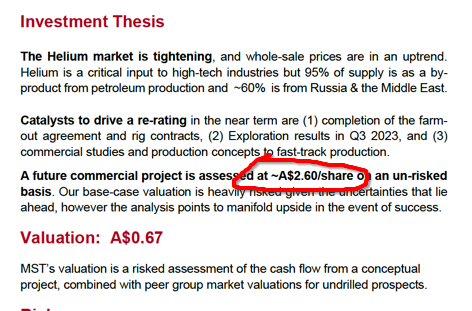

Prior to the capital raise, analysts at MST Access released a very extensive report on NHE. Senior Analyst Stuart Baker placed a 67c price target on NHE on a risked basis.

On success - if NHE can deliver a commercial project - their price target is $2.60 per share.

You can read the full report here.

While that price target does look interesting, we should be clear that analyst price targets are based on a number of assumptions that may be incorrect - they (or us) don't have a crystal ball. It’s definitely possible NHE does not reach these share prices. This is high risk exploration. Never invest on a price target alone, and always do your own research.

Our ‘Big Bet’ for NHE

“NHE discovers the world’s largest helium reserve held by a single company and is strategically acquired by a major company OR a state owned enterprise to secure supply (USA, China, Qatar).”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done and many risks involved - some of which we list in our NHE Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor NHE’s progress since we first Invested and to track how the company is doing relative to our “Big Bet”, we maintain the following NHE “Progress Tracker”:

More on helium and demand from semiconductors

In the late 2000s, helium demand from chips made up less than 1% total global demand.

But in recent presentations, NHE outlined how semiconductor fabrication demand currently accounts for 19% of helium demand.

As chips become more advanced, and more transistors are crammed onto them, they get more complex and heat up quicker - which requires more helium.

With NHE, we’re betting that helium demand could ramp up dramatically as the chip world goes into overdrive with the advent of AI.

The Institute of Electrical and Electronics Engineers (IEEE) for example, lays out exactly why AI will change the demand for chips:

‘AI demands will have lasting impacts on semiconductor design and production. In large part, this is because the amount of data processed and stored by AI applications is massive.’

It’s enormous amounts of data, it’s huge demand processing power, it needs massive quantities of memory storage and ultimately, we think that means a surge in demand for helium.

As we mentioned before, the NVIDIA Corp’s share price run took it to a US$1 trillion market cap on AI chip demand, in turn setting off the share prices of a host of other chip companies.

We think this surge in chip companies' valuations is masking what economists call a “second order effect” for helium - essentially the consequence of the consequence.

The demand equation is simple: AI demand > chip demand > helium demand.

We think the broader market is only seeing the first two steps here.

So while all eyes are on one of the primary sources of demand for helium (chips), few eyes are on the actual supply of helium to fill the resulting demand.

We’ve already seen helium shortages before:

A lack of helium shut down labs and you almost couldn’t put a price on helium, because in some cases, it simply wasn’t available:

For this reason, helium conservation tech is a built in part of many chip plants (fabs) and there are a range of products designed to make sure they don’t waste the precious gas.

For a deeper dive on helium in chip manufacturing, read this article for instance.

And it’s no surprise that in March 2023, the Semiconductor Industry Association (SIA) wrote to the US government saying:

“SIA recommends that USGS [US Geological Survey] leverage every authority to continue the delay of the disposition of the Federal Helium Supply [FHS] and consider other options that would allow for a stable supply of helium in order to avoid volatility and supply chain disruptions while maintaining a stable, predictable supply of helium from FHS.”

Short version - chip makers in the US are concerned that they could run out of helium.

And the same concerns would likely apply to chip makers the world over.

All of this makes NHE’s efforts to secure the future of helium even more important than before.

Previously, NHE was seeking a farm out partner to fund what we think will be a major drilling event in Q3.

Instead of pursuing that farm out, NHE has opted to go for 100% ownership of its project in Tanzania.

Here’s what’s happened with NHE since our last note on the company...

Why a capital raise and not a farm out?

NHE’s managing director Justyn Wood summarised the decision pretty well.

In the following video Justyn mentions that the farm out process was the preferred funding tool for the Q3 drill program because initial expectations for the well costs were “US$12-13M per well” while NHE’s market cap was $30M.

Justyn then discussed that since then, all of the work that had gone into the company’s projects (2D/3D seismic & geochemical sampling) meant that the drilling costs came down significantly to ~US$6M per well.

During this period NHE’s market cap also almost doubled to >$50M.

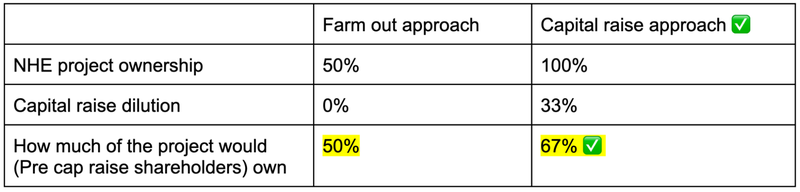

At a very high level it is a simple calculation on which strategy would see NHE shareholders maintain higher ownership over the project and its upside.

- Farm out approach - would have seen NHE lose 50% of its project for up to US$20M in funding. NHE expects the wells to cost US$6M each.

- Capital raise approach - NHE raised $13.5M in capital, diluting existing shareholders by ~33% but retaining 100% ownership of the project.

Summing up, by taking the capital raise approach to the drill program, NHE has managed to retain a 50% additional level of ownership in its project.

Justyn explains it all in the first minute of the following video:

Interestingly, Justyn also mentions that the capital raise was 50% oversubscribed despite being a relatively large one.

In the current market where some companies are struggling to raise their required capital, for NHE to raise $13.5M and still be oversubscribed by 50% is a signal of the potential and upside the company’s projects have.

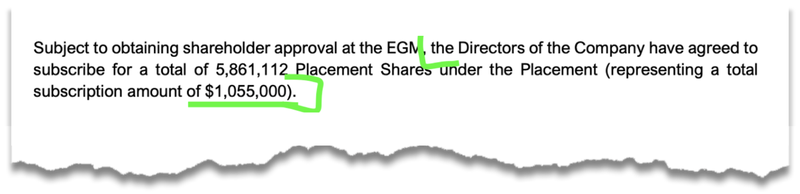

We also note that NHE directors tipped in ~$1M of their own money - which is always a positive signal, especially going into a major drill program.

We think that investors saw this as the last opportunity to get some NHE exposure before the major drilling catalyst next quarter.

The NHE share price since the first batch of the placement shares were issued has traded well above the 18c capital raise price which tells us that either:

- Some of the people who were scaled back in the raise are buying more on market; OR

- Investors who were sitting on the sidelines waiting for NHE’s funding plans to be resolved are now rushing into buy shares.

Typically with large capital raises like NHE’s, the share price is quickly smashed down to the raise price... the fact that NHE has only briefly touched 18c thus far is a positive sign.

Now NHE trades at ~21.5c per share (today’s open).

The next batch of shares from the placement are expected to be issued at the end of August following an extraordinary general meeting.

We will be watching to see how the company’s shares trade between now and then.

What’s next for NHE?

Rig contract and mobilisation 🔄

NHE has already signed a Letter of Intent (LOI) with a drilling company called Sanofi for a rig.

NHE expects the rig to be mobilised in Tanzania in August.

Drilling will then start in September at the basin margin prospect with the second well to be drilled right after in October.

⚠️The Big One: Drilling ⚠️ 🔄

Drilling is expected to start next quarter.

Across the two wells NHE will be targeting a ~16.5 bcf (billion cubic feet) unrisked mean recoverable helium volume.

The two targets represent <10% of NHE’s overall resource which sits at an independently certified Mean Unrisked Prospective helium resource of 175.5Bcf.

Closer to the drilling event, we intend to outline our bull/bear/base cases for NHE’s drilling.

What could go wrong?

After last week's capital raise NHE has addressed one of the overarching risks for any junior explorer approaching an expensive drilling event - funding risk.

The company is now funded for the drilling and testing of its first well next quarter, and can purchase long lead items for its second well.

Once drilling starts, the key risk will be exploration risk.

As is the case with all junior explorers, there is always a chance that NHE’s drill program fails to find any commercial quantities of helium.

Check out our NHE Investment Memo to see all of the key risks we have listed:

Our NHE Investment Memo

Click here for our Investment Memo for NHE, where you can find a short, high level summary of our reasons for Investing.

In our NHE Investment Memo, you’ll find:

- Key objectives for NHE

- Why we are Invested in NHE

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.