Investing part 4: Bargain buys in the small to midcap sectors

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

With a view to taking advantage of extremely volatile market conditions, Finfeed took the opportunity last week to examine the environment from a broader perspective, providing a platform to then focus on a few sub-sectors that may be worth targeting while share prices are still depressed.

It is worth noting though that just in the space of a week as we started this four-part series the landscape has changed dramatically.

The S&P/ASX 200 has fallen from just over 5000 points to a low of about 4400 points, representing a fall of 12%, taking the total decline since the market started plummeting to nearly 40%.

Overseas markets haven’t fared any better with the Dow Jones index having fallen nearly 11,000 points from about 29,500 points in mid-February to close at 18,591 points on Tuesday morning AEDT.

In percentage terms this this was proportionately in line with the decline in the Australian market.

While we have seen more positive signs in the last 24 hours, it is way too early to call a recovery, particularly given that the coronavirus is expected to peak in Australia until May.

Last week we talked about uncertainty in the market and how it could be argued that some stocks presented just as much uncertainty prior to the coronavirus, yet this didn’t deter investors.

Companies like explorers in the mining and energy sectors, as well as enterprises looking for the next big thing on the biotech or technology fronts.

This raised the question as to whether these companies albeit speculative should have been sold down as drastically, particularly given that for the best part their exploration and research activities were uninterrupted and they didn’t have a disrupted revenue/earnings stream.

Moving up the chain to small and mid-cap stocks

Even small stocks that generate earnings tend to fare worse than their larger peers during periods of volatility.

Perhaps this accounts for the 41% decline in the S&P/ASX Small Ordinaries Index (XSO).

Given this backdrop, I felt it was an ideal time to throw the net a little wider, targeting those small to mid-cap companies that appear to be oversold.

As a guide, I have excluded companies with market capitalisations above $2 billion.

In selecting these stocks, I have considered factors such as consumer purchasing habits in the case of retail companies, commodity price movements that relate to the mining industry and balance sheet capacity to ride out the storm.

AP Eagers Ltd - ASX:APE

Shares in AP Eagers Ltd (ASX:APE) hit a low of $2.50 on Monday, before closing at $3.05.

A month ago APE was trading in the vicinity of $9.50, implying a fall of 68%.

With this share price collapse has come a marked decline in the company’s market capitalisation from north of $2 billion to less than $800 million.

This appears to be extremely exaggerated, but it also appears to be unjustified given the company’s past resilience in weathering difficult economic times.

It is worth noting that management came out as recently as Friday, advising that the 22.5 cents per share dividend due to be paid on April 20, 2020 (ex-dividend April 1, 2020) had been reduced to 11.25 cents per share.

However, management also mentioned that it would consider payment of an additional dividend of an equivalent amount later in the year once the level of uncertainty caused by current market disruptions had abated.

The key point here is that APE is financially robust, and the fact that it is paying a dividend that represents a yield of about 3.7% just for the first half is an outstanding effort.

Indeed, this comes at a time when many companies have decided to put dividends on hold.

It is also worth noting that managing Director Martin Ward has taken a 46% reduction in his remuneration package and all non-executive directors have determined to forgo their full board fees with immediate effect.

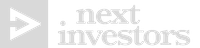

From an operational perspective, APE is the largest automotive retailer in Australia and it has established a prominent position in the industry over a period of 107 years.

The company owns many of the sites where its dealerships are located, representing a prime real estate portfolio.

Looking to the future, in 2019 the company completed the acquisition of its major competitor, ASX listed Automotive Holdings Group, and 2020 will see the first full year contribution from this acquisition.

Baby Bunting Group Ltd - ASX:BBN

While Baby Bunting Group Ltd (ASX:BBN) is classified as a consumer discretionary retailing stock, most of its big selling higher price point items could be considered non-discretionary - in other words they are items that consumers have to buy.

While not quite like groceries are to consumers, Baby Bunting’s products such as cots, prams and baby capsules are must haves for the new arrival.

Let’s face it, regardless of the coronavirus babies will still be born at the normal rate throughout the anticipated course of the virus - the baby conceived around the start of fiscal 2020 will still arrive over the next few months.

Furthermore, as the baby grows, different types of prams and car seats are a necessity.

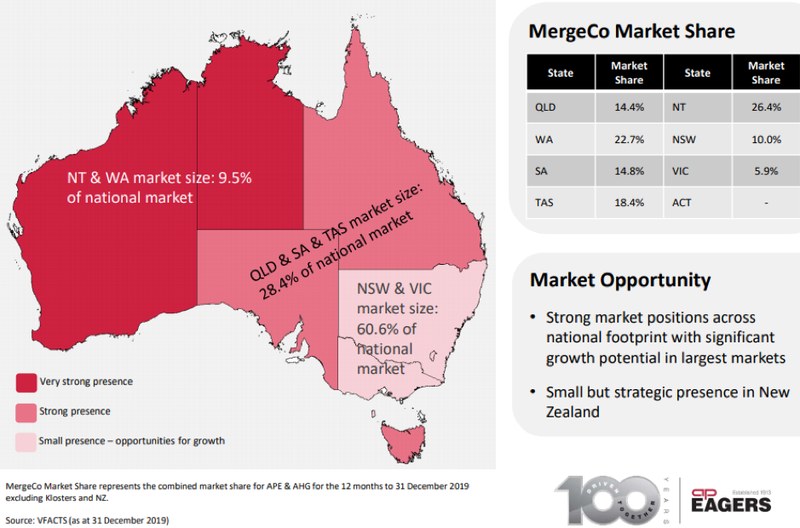

Throw into the mix products such as nursery furniture, bassinets, bottles, nappies, toys and clothing and you have a $2.4 billion addressable market.

Baby Bunting is the only national specialty baby goods retailer with stores across all states.

Management estimates that there is scope to increase current store numbers of 56 to more than 80, making the group a scalable business that can generate growth through existing business, as well as by executing on its store rollout strategy.

The following graphic demonstrates the company’s market position.

You will see the mix of pure play online retailers featured in the right-hand corner.

As indicated, Baby Bunting has a branded store presence on eBay, but it is important to note that the group’s investment in its own online sales platform has been well rewarded.

Website visits are growing rapidly with unique visits exceeding 10 million for the six months to December 31, 2019.

Online sales grew 10.5%, but importantly ‘click and collect’ represented 45% of all online sales where Baby Bunting has a store, and 96% of all sales involved a customer store visit in those catchment areas.

Consequently, the company isn’t likely to be left behind due to a shift to online retailing, as has been the case with many bricks and mortar businesses.

However, on this front it is important to note the company’s product mix.

The likes of cots, prams and car seats account for more than half of group sales.

These tend to be touch and feel type consumer items where purchasers want to get a personal appreciation for what they’re buying.

With the likes of prams and capsules/car seats, it is helpful to receive instructions regarding their features and fitting.

Products such as nappies, bottles and dummies are consumables that require replacement which means the consumer is not only required to purchase new products, but it can also be a catalyst for them to revisit the store, perhaps providing further sales opportunities.

Given this backdrop, it is difficult to understand the indiscriminate selling that occurred in mid-February as the company’s shares plunged from about $3.80 to a recent low of $1.60.

A strong rebound occurred on Tuesday following a trading update by management which was provided after the market closed on Monday.

However, the company appears to still be trading well short of fair value.

Crunching the numbers, between December 30, 2019 and March 22, 2020 management reported sales growth of 12.4%, including comparable store sales growth 6.2%.

The average established retailer would take these comparable store sales figures in any environment, but particularly as things currently stand.

On a year-to-date basis, total sales are still tracking at 10%.

The company hasn’t been unduly affected by supply chain issues, and management said that these have generally returned to normal.

However, given the uncertainty surrounding the impact of coronavirus management has taken the decision to defer around $7 million in capital costs that was scheduled for the second half.

These were mainly associated with the rollout of the new brand across the full store network.

This appears to be an astute move as it will provide financial flexibility while really only staggering the earnings growth momentum that was forecast over the next two years.

Analysts are forecasting earnings per share growth of about 16% and 20% in fiscal years 2020 and 2021 respectively.

This compound annual growth rate of about 18% could well be delivered with some slight timing differences, suggesting a PE multiple of about 18 could be applied to the mid-range of earnings projections for the next two years which is in the vicinity of 17.5 cents.

This implies a share price of $3.15, slightly shy of broker consensus price targets.

However, it does indicate that there is substantial upside of about 75% to Tuesday’s closing price of $1.80.

Consensus forecasts point to dividends of 10.5 cents and 13 cents in fiscal years 2020 and 2021 respectively.

Baby Bunting’s ability to meet these forecasts may be impacted by the coronavirus, but management hasn’t commented at this point in time whether that is the case.

However, even if the dividend over the next two years is in the vicinity of 10 cents per share this implies a yield of about 5.5%.

Taking into account the benefits of franking, this equates to a grossed up dividend yield of about 7.7% - better than bank interest.

Macmillan Shakespeare Ltd - ASX:MMS

Macmillan Shakespeare (ASX:MMS) is another company that has been the subject of a substantial sell-off in the last month with its shares collapsing from about $12.00 to hit a low of $5.01 last week.

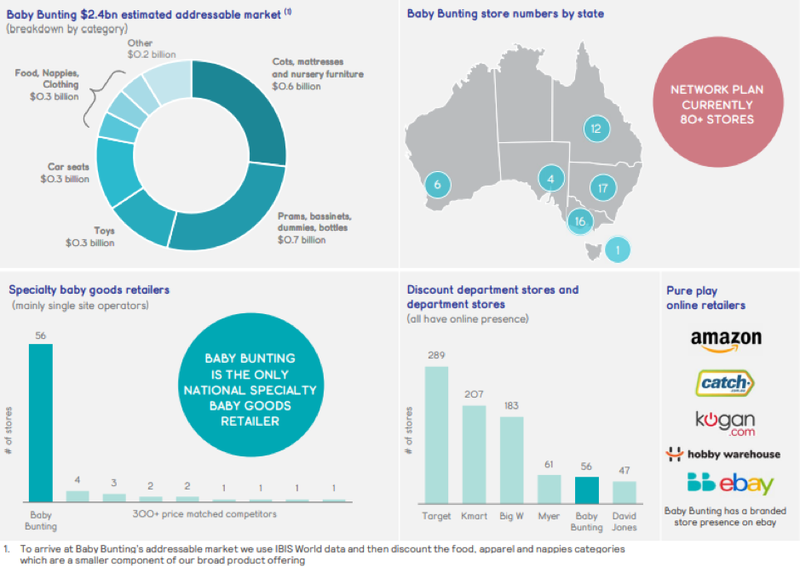

The company is a market-leading provider of salary packaging, novated leasing, asset management and related financial products and services.

The group is represented across Australia, New Zealand and the UK, and it domestically manages programs for some of the largest public, private and charitable organisations.

While more modest than fiscal 2018, the 2019 result reflected a period punctuated by difficult trading conditions, increased competition and a changing regulatory environment.

However, management is experienced in managing challenging environments as has been evidenced in the past in relation to prospects of regulatory changes with fringe benefits tax and the global financial crisis.

Despite the challenges faced in 2019, management worked towards building a sustainable platform for future growth through leveraging the scale that has been built over recent periods and pursuing strategic growth priorities.

Significant milestones were achieved, including the retention of major clients for the long term in the company’s core Group Remuneration Services (GRS) business, as well as securing substantial new contracts in this segment.

Macmillan Shakespeare is in the process of growing its UK asset management and broking businesses into a substantial, profitable business, and management is satisfied with the progress to date given that it has already established itself as one of the top five providers of asset finance in the local market.

Assets under management increased, and assets have been divested in order to improve returns on capital.

Uncertainty with respect to the political and economic environment, a significant reduction in asset finance growth in the broader market and historically low interest rates, along with a reduction in new vehicle supply as a result of changes to European vehicle emission standards presented challenges.

However, despite challenges in its overseas operations and a depressed motor vehicle sales market in Australia, the broader group continued to perform well and it remains financially robust.

Of particular note was the Plan Partners business which delivered solid growth underpinned by a substantial expansion of the customer base, resulting in the total value of client plans under administration increasing from $86.3 million in fiscal 2018 to $269 million.

The following graphic which includes the global financial crisis shows the group’s resilience, as well as demonstrating the impact of incorporating the asset management business, and more recently the Retail Financial Services (RFS) operations.

Macmillan Shakespeare declared an interim dividend of 34 cents per share for the first half of fiscal 2020.

While the impact of the coronavirus could prompt management to temper the second half dividend, history shows that the company is quick to bounce back, and while the consensus forecasts for a full-year dividend of 69.5 cents may not be met, it could be more a matter of it running into fiscal 2021.

Even though Macmillan’s share price staged a recovery on Tuesday, trading in the vicinity of $6.70 (+6.9%), the company’s yield potential of about 10% based on today’s price is clearly evident.

National Storage REIT - ASX:NSR

For investors who are attracted to the yields offered by the real estate investment trust (REIT) sector, National Storage shapes up as a worthwhile contender.

With the value of properties and the locked in recurring revenues that stem from rents normally anchoring the broader share price valuations in what is a resilient sector, it was an incredible fall from grace as the S&P/ASX 200 REIT Index (XPJ) plummeted 50% from about 1730 points to a low of 870 points.

No doubt there are concerns regarding rental declines due to those businesses that have had to close their doors due to the coronavirus.

Interestingly, National Storage bounced back strongly on Tuesday with its shares increasing more than 7%.

However, its shares closed at $1.45, representing a 97 cents per security discount to the takeover offer received from Public Storage (PSA) as recently as February 14, 2020.

While this offer has now been withdrawn, when the dust settles it would appear that a potential suitor will have to at least come up with an offer north of $2.00 per security.

As a guide to the company’s yield potential, which is important given that there won’t necessarily be a new suitor waiting to take the company over, prior to the advent of the coronavirus and the receipt of the takeover offer, analysts were expecting National Storage to distribute 10 cents per security in fiscal 2020.

The group was nearly halfway there, having returned 4.7 cents per security for the first half of fiscal 2020.

The full-year estimate would equate to a yield of nearly 7% based on pre-coronavirus consensus forecasts.

There is no point in trying to estimate what the distribution will be like in fiscal 2020 for most REITs, but National Storage may be a little more predictable than those trusts that are reliant on income from large shopping centres, the hospitality industry or CBD tenants.

As a backdrop, with a market capitalisation in excess of $1 billion National Storage is the largest owner-operator of self-storage centres in Australia and New Zealand, with more than 180 centres, providing tailored storage solutions to over 70,000 residential and commercial customers across Australia and New Zealand.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.