ESK Sees 169% Jump in Revenues as its Radio Tech Brings it Back in the Black

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Just this month, researchers in the US managed to turn band posters and t-shirts into localised radio stations which can send data to nearby smartphones and radios.

They did this by piggybacking off ambient FM signals .

Industry experts are making strides in this area, and while poster-radios aren’t exactly top of everyone’s priority list, it’s all part of a trend leading us towards ever-smarter, and wire-free, ways to communicate.

In the fields of security (including disaster and emergency management), utilities and resources, wireless and radio-based communications are becoming extremely important.

For the simple reason that in these situations, emergency workers need methods that aren’t reliant on an internet connection or wiring. They need to be rapidly deployed, work dependably and in any location or scenario imaginable.

Take a terrorist attack, for example. Communication is absolutely key to managing an event like this – and there’s no time to waste setting up wiring or organising high internet speeds in whatever random location the incident is occurring.

Cue Etherstack (ASX:ESK).

ESK identified this need several years ago and set about developing, manufacturing and licensing mission critical radio technologies across the globe.

Its focus has been to provide deeply reliable communications, resilient against all sorts of adverse situations and products fit for emergencies.

Put simply, ESK supplies “mission critical” and public safety standard communications equipment for system integrators and network operators, with a user base consisting of police, fire, ambulance, utilities, and mining sectors globally.

Now, before we go too far, we should note that this is an early stage stock and those considering an investment should seek independent financial advice.

In February, ESK released outstanding full year results :

- Revenues grew by 169% over the year to December 31, 2016.

- US$1.54m turn around in underlying EBITDA to US$836,000 from negative US$703,000 EBITDA in 2015)

- Major increase in recurring revenues driven by cumulative long term support contracts

The revenue growth was driven by the combination of new network expansion projects, licence deals and growth in recurring royalty and support revenue payments.

ESK is finding more interest, from corporations wanting to exploit its first-in-class technology through to new investors.

It’s also broadening its government customer base in Australia and the US, including its first ever Australian Department of Defence orders.

It looks to us like it’s the time start paying attention as the benefits of ESK’s carefully laid plans start to flow through.

On that note, let’s turn our attention to this wireless tech play and see if we can get on its frequency:

While we can live with a text message going missing or an Instagram blast disappearing, the same cannot be said for messages transmitted in an emergency situation.

In the case of a natural disaster, reliable and clear communication between authorities especially between multiple emergency services agencies – and between ordinary citizens – is absolutely crucial.

Reliability as well as capacity are non-negotiable traits, here. There’s no time to ‘turn it off and on again’ or call Telstra. It simply must work when it’s needed.

You might know all of this if you’ve followed our earlier coverage of Etherstack (ASX:ESK ), but let’s just say we’re not the only ones who have taken notice...

Cash flow positive meets promising projections

ESK has been working to get back on its feet in an industry sector knocked around by the GFC. This shone through with the impressive full year result reported in February.

Revenue growth of 169% marks a huge turnaround for the company.

This was a hard-won result for ESK, having secured and successfully delivered several multi-million dollar projects in North America in the 2016 calendar year.

Most contracts were with large corporates and utilities, which provide excellent exposure bringing long-term earnings streams.

Part of its plan in 2016 was to hit the local angle, and it greatly expanded its customer base in Australia with its first order from the Australian Department of Defence.

In all of this news, a key thing to remember for a company like ESK is the importance of recurring revenue and how this could set it up nicely for the future.

A little bit of history repeating

Right now the company can boast a good quota of recurring revenue , with income from royalties growing by 182% over the year... you can read that as a BINGO on the balance sheet. These royalty and support revenues are less volatile than project revenues and help to smooth earnings.

It turns out that a year of impressive earnings was not the only thing to give ESK’s outlook an improvement.

The multiple contracts it signed had something to do with it also.

It’s variety of revenue streams can be summed in a few groups:

- Mission critical radio network sales (it has an installed base of five major utility networks in the US, Canada and Australia)

- Technology licensing (some of the world’s biggest companies in wireless and IP equipment pay royalties to ESK on sales of products shipped under their own brand)

- Ongoing services as ESK offer 24/7 network support; and

- Rolling royalties, customisation and integration services.

Looking at it from this angle, to set itself up for profitable long-term future ESK just need to stick to its program and repeat the contract success it has already seen.

Maintaining client support could be a key area of strategic interest. Whenever you have a patented and top-notch technology that’s sold via contract, there’s ongoing work in assisting the contractee to use the product optimally, and troubleshoot any gaps in service or needs that crop up. This means you can count on regular support services payments.

When you combine all earnings streams, you get a pretty solid basis for a business that’s going to perform in the near and long-term.

It should be noted, however, that any performance projections are speculative at this stage and should not be taken as guaranteed. Investors should seek professional financial advice for further information.

ESK’s bumper revenue plus its small market cap of just $22 million could be an interesting opportunity.

In its results announcement for the year to 31 December 2016, ESK reported income from support and royalties at US$1.7 million (A$2.2 million) in 2016. That’s close to double what it reported in 2015, at US$550,000.

Support and royalties account for 18% of the company’s revenues and have grown 93 % in 2016.

Support and royalties streams are both contract based, so what else do they provide? It’s something that investors love — predictability.

The company’s network projects are expected to deliver revenues not just in the year of deployment but beyond, as contractees expand established networks and require ongoing support and integration or upgrade services.

And as far as future contracts go, it would seem the ESK’s main business opportunities – defence, utilities, transportation and resources – are unlikely to slow down any time soon.

Another aspect that should nicely balance ESK’s books is the fact its financing costs reduced over the year when it repaid debt following a capital raising.

ESK said it is optimistic that its positive 2016 revenue result is a good sign for 2017 and 2018, in which it expects further revenue growth. This will be especially true when newly developed products and technology start to contribute to revenues.

A recap of prior deals

In 2016, ESK signed a major 60 million yen (A$700,000) contract with NEC Corporation. The deal means that ESK’s wireless technology has been incorporated into NEC’s products to de-risk and accelerate delivery of sophisticated radio systems. All sounds pretty good, we think.

In another major deal for the year, ESK expanded an existing deal with BAI Communications.

But those weren’t the biggest deals of the year – towards the end of 2016, ESK secured a US$3.1 million (A$4 million) network expansion deal with ATCO Electric. The agreement is now seeing ESK’s technology expanded to additional sites, and greater capacity of the ATCO Electric P25 digital radio network which supports the company’s electricity distribution and transmission operations in Canada.

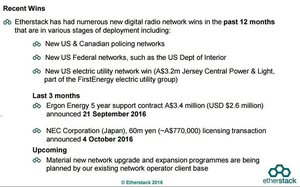

Here’s an overview of ESK’s deals for the period:

There’s no doubt that escalating world events that require ESK’s services — like terrorism and climate change-related natural disasters — are sure to further increase demand for the company’s well-developed tactical communications products, such as its Go Box.

How much of this demand remains to be seen, so investors should seek professional financial advice if considering this stock for their portfolio.

“Go Box” is a compact tactical repeater allowing for two way communications, without requiring external power, and is designed to withstand the harshest of environments.

It looks like this:

Trust us, you would want this thing in an emergency.

What’s happening in 2017

Expansion seems to be a key word for ESK’s current game plan.

It remains to be seen just how long its market cap will stay hovering around the $20 million market cap the way it is now.

Its recent wins are starting to put money in the coffers... and it’s not hard to see that continuing well into 2017.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.