BIG Catalyst Imminent: Is this Company Now Cash Flow Positive?

Published 31-MAR-2016 10:43 A.M.

|

16 minute read

When it comes to investing in potentially game changing tech stocks, there is a big factor investors often ignore.

Revenues.

A good tech story has the ability to put the proverbial rose-colored spectacles on any investor; all too often caught up in the blue sky story, rather than remaining focused on the stone cold fundamentals.

There have been dozens (if not hundreds) of tech-focused ASX hopefuls that have come with good ideas, and left with tails between their legs...

Why?

Because the focus on revenue growth and other financial metrics was largely forgotten which eventually leads to ends not meeting like they were supposed to.

One company we’ve been tracking for the last year, is doing exactly what tech companies should – come up with a good idea but also commercialise it to smithereens as early as possible.

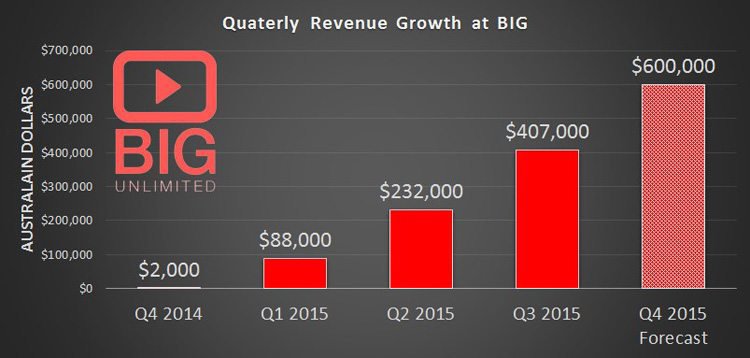

BIG Unlimited (ASX:BIG) has seen its revenues double almost every 3 months over the past year...

BIG’s financial performance to date gives us confidence that this tech disruptor could be the real deal.

BIG just revealed cash receipts for the three months ended 31 March 2016 are expected to exceed $1.1 million...

That’s an increase of approximately 70% over the past quarter – and over a 1000% growth since the same quarter last year.

For a tech company that listed on the ASX on the last day of 2014, that’s a pretty strong milestone to be hitting so early on.

To add the icing to the cake, cash flow positivity is expected to be achieved in March

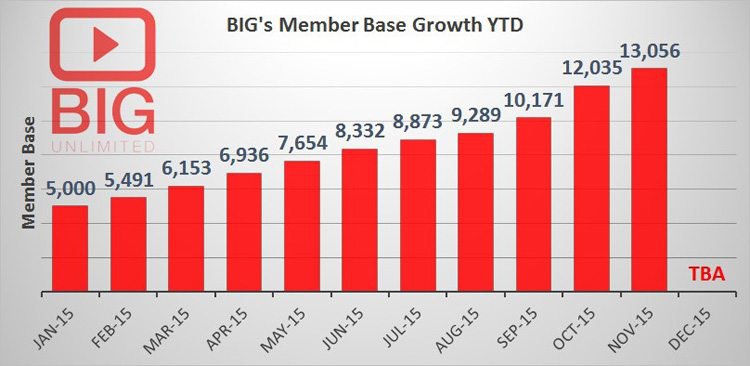

The company is also hitting big milestones with membership numbers – which now stand at over 14,000, and the company expects this to more than double by the end of this calendar year.

Not only has BIG grown its revenue, added new members and consolidated paying customers, it has also struck key enterprise partnerships, to ensure the company continues to grow and move to solid profitability.

Keep in mind however that this is still an early tech play and comes with all the risks inherent in that.

The company’s progress has been aided by ‘Xero hero’; Ms. Leanne Graham – one of the world’s best Software as a Service (SaaS) marketers, who is aggressively focusing on enterprise solutions for BIG’s customers – which given her sales success at Xero, should convert to solid numbers on BIG’s bottom line.

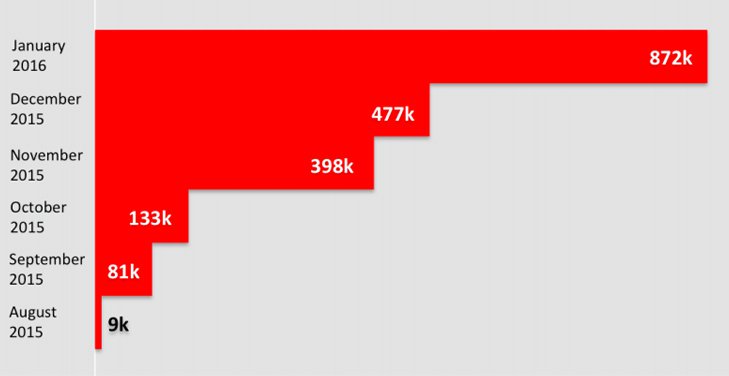

There are more fast facts for BIG recently in February, BIG Review TV content passed 1.2 million views.

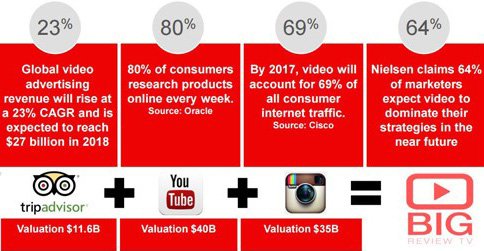

BIG has managed its early success because it plays in one of the more lucrative advertising formats out there – online video.

In an age where it costs a lot to make a TV or radio ad, those channels’ effectiveness is being eroded by more dynamic and interactive online variants such as mobile, social media and video.

BIG has managed to navigate its way to be at the forefront of the small-to-medium enterprise (SME) advertising revolution.

While its core business continues to come on in leaps and bounds, it is broadening out the revenue base continuously, with a new foray into SaaS products hinted at – demonstrating that this tech play is far from a one-trick pony.

Re-introducing:

Big Unlimited

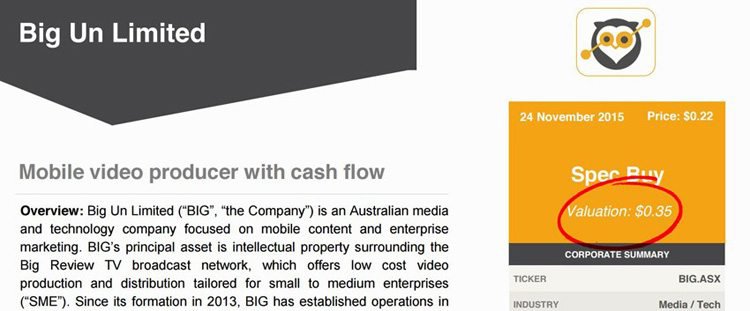

BIG Un Limited (ASX:BIG) is talking a big game, but it is also walking the walk with cold hard sales.

BIG is on track to reach cash flow breakeven point in March – and confirmation of this provides an imminent catalyst for this stock.

For the quarter ending March 2016, total cash revenues are expected to exceed $1.1 million – which is a 70% increase on the prior quarter that ended 31 st December 2015.

If you’re looking for rain, ask a Rainmaker

Just before Christmas last year, former Xero executive and tech entrepreneur Leanne Graham joined BIG’s advisory board, adding even more tech muscle to the play .

Ms Graham has over 28 years’ experience in the space, specialising in the ‘Software as a Service’ (SaaS) sector.

As general manager and global head of sales at Xero, Ms Graham successfully led the sales strategy and during her three year tenure the customer base increased from 4000 to over 120,000 enterprise and SME customers.

You may have seen her name pop up elsewhere. Last year she joined the Board of Velpic (ASX:VPC) – and you can read a little more about that in our article: Sales ‘Rainmaker’ from $2.6BN Tech Giant Joins ICX Takeover Target Velpic .

We first covered the VPC story when it was the subject of a Reverse Take Over of International Coal (ASX:ICX). The VPC re-listing went fairly well to say the least – up as high as 180% over the first few days of trading, with the share price now hovering around $0.05:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Ms Graham has influenced VPC’s successful SaaS platform growth – and BIG will be looking to her knowledge, skills and networks, to guide it into becoming another Aussie tech powerhouse.

Ms Graham has already taken an aggressive approach to helping build BIG’s business model. As the company has moved away from a ‘cold call’ model to enterprise partnerships, Ms Graham’s experience and contacts will continue to prove invaluable as BIG grows and more partners come knocking on the door.

Ms Graham will also add weight to BIG’s own SaaS play.

BIG is currently modelling a Video Eco System SaaS play and is expected to release a far more diverse platform in the future.

It is in these SaaS plays where Ms Graham excels. Clearly, she knows what SME businesses need and want and she’s joined ranks with BIG to share that expertise.

Here she is on the cover of NZ Business magazine:

Her comments upon joining BIG were rather insightful too:

“Digital marketing is rapidly evolving and small and medium enterprises are looking for innovative and disruptive solutions to enable them to grow and expand their businesses,” she said. “It is clear that video marketing content is becoming an essential element for every business.”

“BIG’s executive team are passionate trailblazers, and I’m incredibly excited to be involved and providing them with go to market advice. BIG is a digital marketing disruptor, whose B2B video offering enables businesses to reach its audience in a new and innovative way.”

We couldn’t have said it better ourselves.

Let’s take a step back and look at the broader play that BIG are shooting for.

The BIG deals

Recent months have been somewhat of a busy time for BIG as it signed deals left right and centre to shore up revenues and bring in partners that could help it expand beyond its current borders.

The most recent deal was signed with GeoOP (NZX:GEO) – and it has been tailored so that BIG can target GeoOp’s 21,000 SME client base in over 35 countries.

The deal validates BRTV’s offering and the way it feeds into market demand for video content solutions.

BIG also recently sealed a distribution agreement with cloud-based analytics company, DNA Behaviour International Resources. The deal will see DNA sell Big Review TV video products to small-to-medium enterprises based in Manhattan and Brooklyn.

It intends to leverage its existing customer base to grow BIG’s product in the US.

In fact BIG told investors that the deal could effectively add 5000 SME members to the platform in 2016, adding to BIG’s existing 14,000+ member database.

According to BIG’s Management, this deal vindicates their decision to set up sales teams in San Francisco and New York for the past seven months.

And with the US deal in the bag, BIG is now eyeing further expansion because DNA’s footprint is global. In fact, DNA has clients in 140 countries.

You can see where this is starting to go now with regard to BIG’s global expansion strategy...

So which kinds of avenues can BIG and DNA move into hand-in-hand?

Here is an estimate compiled by Telsyte of how many SME’s BIG could potentially commercialise, split by sector.

As you can see, BIG has an addressable market of 7.5 million SMEs across its operating regions. In future, as more regions come online, the amount of business BIG is targeting and the amount of users looking at BIG’s videos are likely to rise.

Of those 7.5 million, if we look at Australia in isolation and assume a 42%-17% uptake rate, BIG has over 200,000 business it can realistically do business with, and that’s only in Australia.

Bear in mind that BIG has been growing almost exponentially, and yet its member base is still only around 14,000.

With 200,000+ more businesses to go after plus a global presence to establish, there is every chance BIG can continue its strong revenue growth as part of its international expansion.

However, we should note that this is still an early-stage tech play – so it’s always a good idea to seek out professional financial advice when choosing whether or not to invest in BIG.

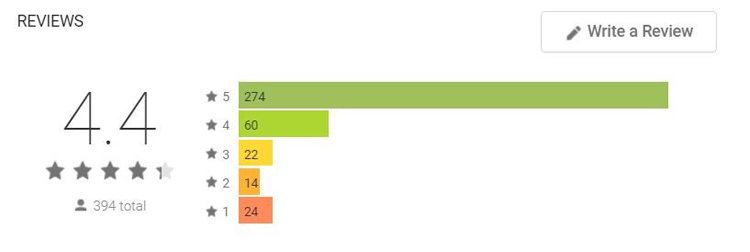

If we take a quick look at how BIG’s popularity amongst end-users is doing, it’s clear that BIG is moving in the right direction:

BIG has seen its view numbers double in each and every month since August last year.

Hitting the ground running and keeping pace with its initial blue sky estimates, is what has reaffirmed our confidence in this stock.

So how does BIG make its money?

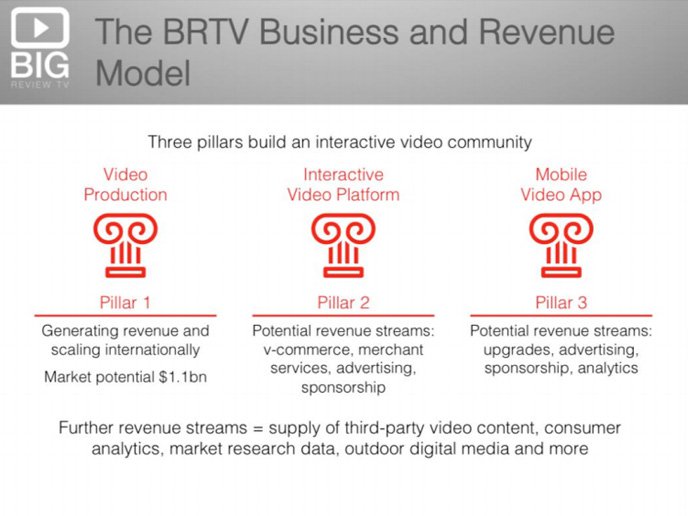

BIG has outlined a three-pillar strategy to build for success.

Pillar 1 is already alive and kicking, with Pillar 2 now starting to generate revenues courtesy of BIG’s sponsorship agreements.

Pillar one – Video Production

This is the more established side of BIG’s business, and one with a potential $1.1 billion market opportunity.

In a nutshell, it approaches SME businesses like cafés, restaurants or even theme parks, and films online video reviews of their business.

Below is an example of the type of high quality content BIG can provide, including a demonstration of sponsorship opportunities – this is a great example of BIG’s Pillar 1 and 2 working in tandem to deliver a quality product for its membership base:

A video of this type would typically cost $5000 – $10,000 per featured business to produce depending on complexity, length, location and resolution. For a café or restaurant, shooting a video is one thing. For a theme park or a fitness centre, the parameters understandably change.

The same video done by BIG would cost each business featured $399 upfront and $10-$80 per month thereafter for their own individual edit. Plus there is the opportunity for small businesses to collaborate with bigger brands as demonstrated and include sponsorship.

Such a competitive pricing structure effectively allows millions of individuals, as well as small-medium sized businesses (SMEs) to obtain high quality video content to advertise and promote their businesses.

This is where BIG has the advantage.

By offering a lower initial price point and then an ongoing fee, BIG is able to convince SME business owners to take the next step in the business development – by jumping into the weird and wonderful world of online marketing, promotion and e-commerce.

The big news at BIG is that quarterly revenues have breached $1MN in advance of pre-set expectations and most importantly, BIG continues to set a breakneck pace by doubling revenue numbers almost each quarter since the end of 2014.

When we take a look at how many users BIG has in its pipeline, here too a rapid rate of growth is evident:

Pillar two – Video Platform

Once the videos are produced, they have to go somewhere rather than simply exist in isolation.

Enter the Big Review TV platform.

The whole point of the platform, for clients, is to have an in-built audience for the content produced. Here, we are talking about people who visit the site for the latest review on where to dine, play, or stay on holiday.

Generally speaking, video is by far the most engaging media platform with multiple senses engaged, and BIG’s well-produced videos mean that watching is a pleasurable experience.

With an online audience comes the chance to monetise that audience.

We’re talking pre-roll advertising (the ad which plays before the video) and sponsorship opportunities.

By its very nature, Big Review TV attracts people who are interested in goods or services and are actively seeking out information about it. This is an advertiser’s target audience goldmine.

And this facet of the business is also starting to ramp up as part of BIG’s 2 nd pillar.

BIG told its shareholders at the start of the month that it had tied down a deal with fashion label Mojo Downunder .

Mojo is getting access to ‘pre-roll’ advertising.

Its ads will show before content related to fashion on BIG’s platform, which makes sense as people interested in fashion may very well be interested in Mojo’s product.

It’s looking like BIG, through the Mojo deal, is building a ready-made case-study to take to potential advertisers into the future...

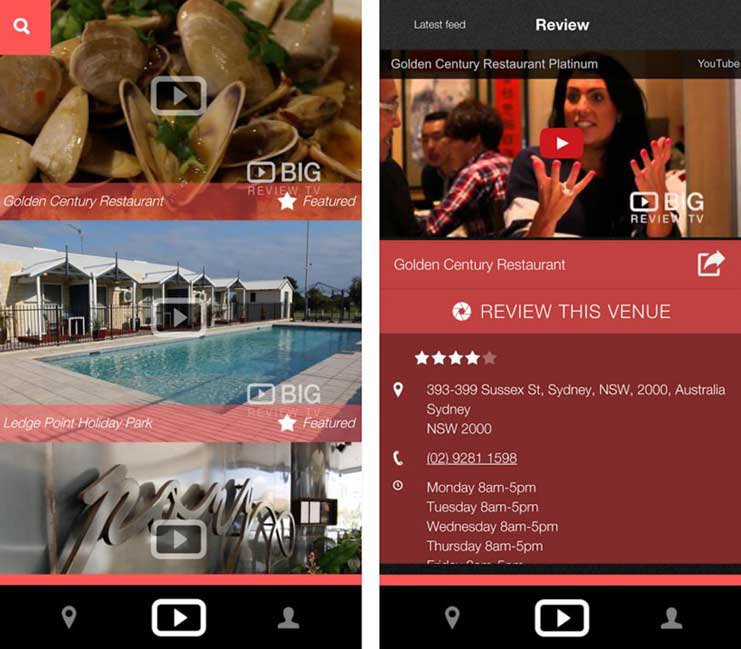

Pillar three – Video App

The Big Review TV app is now live on iOS and Android .

Here’s a snapshot of what it looks like in action:

The opportunities here are similar to those being presented by the Big Review TV platform in that BIG may look into charging for advertising, but the great thing about being an app is that it gathers a lot more information about the user.

In fact, according to some studies in-app mobile ads are twice as effective as mobile ads when it comes to click through.

Hence, in-app ads are tending to attract a premium in the marketplace. It also collects a lot of metadata, which it can pass on to other buyers (with the user’s permission, of course).

The vision is to use this data to build a profile of a person it can pass onto advertisers.

Imagine if a person is looking to buy a pair of shoes in the Sydney CBD area, and looks up reviews of shoe stores accordingly within the app.

Eventually, BIG will offer in-app advertising opportunities and will be able to tell advertisers that it has a user with a particular IP address who is interested in fashion in the Sydney CBD area.

So, an advertiser selling cool dresses decides to target this user with an ad for their store within the app, linking the user to the company’s own Big Review TV page.

The advertiser gets access to an eyeball which is interested in fashion within the area, and the user gets served an ad for a product they may actually be interested in – rather than foot fungus cream.

Big blue sky

In a nutshell, this is the overarching business model BIG is trying to build:

It’s aiming to plug into trends which have all proved profitable in the past and are being tipped for huge things in the future.

BIG is hijacking the video production space by undercutting its competition, providing a platform for consumer information, giving people a chance to upload their own reviews, mixing it all with online video and adding a dash of social sharing.

Review sites and sites which offer advertisers scope for video content are bringing in the big valuations and booking some seriously big profits.

For BIG, the aim is to build a TripAdvisor / Zomato -esque consumer platform with video built-in from the ground up. Then, by overlaying user reviews on all its entries, Big Review TV encourages people to leave their own video reviews of a particular business.

Those reviews are then shared on social media, leading to increased exposure for the business which is being featured.

Why mobile video is so hot right now

Next time you’re using public transport, have a quick glance around.

More than likely, you will see something resembling this:

Books and magazines were fit for mass consumption on public transport not too long ago.

But today, finding someone with a book is a challenge rather than a piece of cake. Instead, people are using smartphones, tablets and even laptops that use broadband connectivity and streaming HD content.

If you can get away with it, take a look at what’s on those screens.

More often than not, it will be video.

Data networks (broadband, Wi-Fi and otherwise) are now at the point where they can handle large video files without the dreaded ‘buffering’ animation, so given the option, people are choosing to watch HD video in their droves.

While TV does remain a dominant media platform, it is well and truly having its lunch eaten by the likes of YouTube, Facebook, and Netflix.

Even TV networks are starting to evolve from primarily broadcast networks into services that also offer streaming.

Advertisers and marketers are catching onto the trend as well.

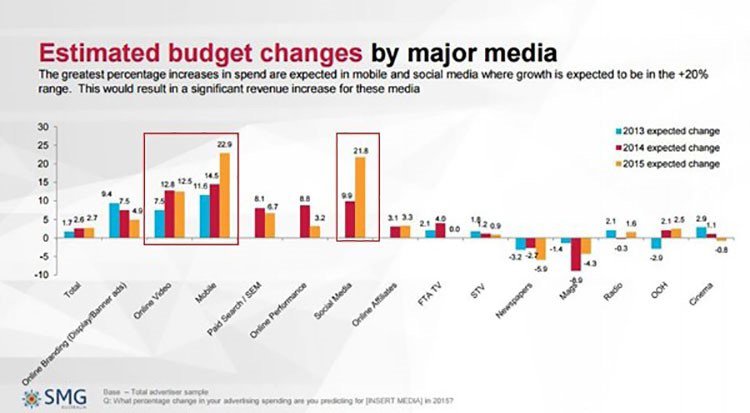

This is a chart we’ve used before, but it’s one which demonstrates the intentions of advertisers.

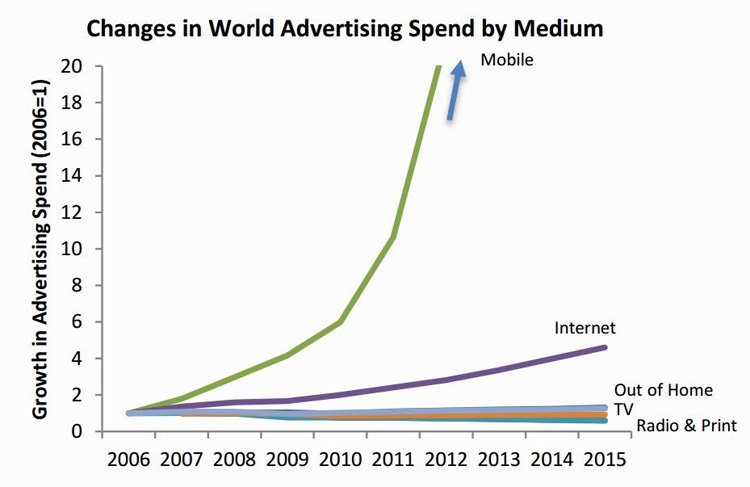

And here’s an alternative research report from Wise Owl, which paints a similar picture:

The three standout growth areas into which advertisers are most keen to prioritise are online video, mobile and social media.

That’s a pretty good fit for BIG who are all about video, mobile and social media.

The Final Word

BIG is a tech play with a difference, and it’s already out-performing its own revenue expectations.

With financial metrics stacking up as expected, a host of talent already on board and a market landscape that is still in its infancy, BIG is a tech company with momentum building and cash flow positive operations arriving.

The main difference between BIG and some the other tech start-up contenders, is that BIG has managed to outfox the majority of its tech brethren by finding a path to generating strong revenues right from the get go.

BIG is tapping into three growing global trends – online video, peer generated content and mobile video creation with all three seeing immense levels of growth at present.

Online video is pervading more and more of what we watch, peer-generated content is now being utilised in variety of ways including social media, while mobile phones continue to get better and better – taking video creation capabilities to the next level each and every year.

BIG offers speculative exposure to the growth in demand for online video – especially from SMEs.

BIG has established a strong revenue profile, large sales pipeline of over 14,000 members, and a long term strategy focused on e-commerce surrounding video reviews.

However at the same time this is a speculative investment – and investors should consider a range of factors, including their own personal circumstances, not just this article, before choosing to invest.

The idea of online video remains very new despite YouTube being around for years now, so not only does BIG present a unique opportunity for exposure to online video, it also has a first-mover advantage backed by patents that will ensure competitor supremacy for the foreseeable future.

All of the above are attractive qualities for a company valued at merely $10MN but already generating $1M+ in quarterly revenue.

It’s a ground floor entry in what could turn to be the mother of all skyscrapers if online video participation (and its associated e-commerce element) continues on its upward trajectory.

BIG has successfully founded, launched and monetised the world’s first socially-integrated, interactive video ecosystem at just the right time to capture the growing trend of online, mobile and video in one BIG swoop.

Everything is shaping up nicely, and we can’t wait to follow the BIG story as it continues to unfold.

Have you heard about the Next Investors VIP Club?

Joining this Club will give you free access to opportunities not normally available to general retail investors – however you must qualify as a sophisticated investor under Section 708 of the Corporations Act.

These opportunities are as diverse as stock placements, seed capital raisings, IPOs, options underwritings. Plus a whole host of other high risk, high reward investment opportunities not available to the general public (careful – this stuff is high risk!).

Just fill in the form and you will be alerted to the next opportunity.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.