ASX Company to Supply to World’s Smart Phone Makers?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There is one thing people really want from their smart phone – a scratch resistant screen. Smart phone makers are clamouring over themselves in a race to develop the strongest, brightest and most scratch resistant displays they can. Gorilla glass is currently widely used, but there is something potentially better out there on the market, and phone makers from Apple to Huawei in China know this. Its sapphire glass – made from artificial sapphire.

There is a good chance your next new phone screen will be sapphire glass made from artificial sapphire.

To make artificial sapphire, you need a healthy dose of High Purity Alumina.

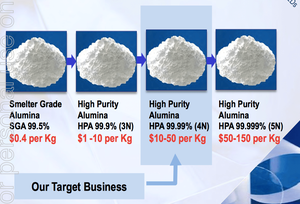

Defined by its purity, higher end 99.99% High Purity Alumina sells for up to $50/kg... It’s estimated that 30g of High Purity Alumina could go into an iPhone sapphire glass screen – 300 million iPhones were sold from 2013-14, and a predicted 200 million are to be sold next year... That’s just Apple alone. All in all, 500 million smart phones are sold every year... Huawei, the world’s biggest telecoms equipment maker is using sapphire glass for some of their phones already, and the Japanese $16BN phone maker Kyocera has also started selling phones with sapphire glass ... High Purity Alumina’s use in scratch resistant artificial sapphire glass is just one use for this very modern material. The bulk of High Purity Alumina is actually sold to make LEDs, semi-conductors and phosphor based applications. In fact, drawn from all the uses, there are predictions the demand for High Purity Alumina (HPA) will rise more than 150% in the coming four years. It’s clear that the world needs more HPA – and in ever growing volumes... The only problem is, it’s not easy to get your hands on it... We are invested in a company that has developed an innovative process to turn alumina enriched clay into 4N (99.99% pure) High Purity Alumina. In fact, we have been following this company for quite a while... Alternative processing methods are more than double the price compared to this company’s method – they can simply use off the shelf plant and equipment. Not only does the company have a breakthrough processing method – it also owns a 65 Mt JORC inferred and indicated resource just east of Perth in Western Australia to use as feedstock. This feedstock has already been processed by Mother Nature over thousands of years – resulting once again in cheaper production costs for this company. This company has plans to become a top three global producer of High Purity Alumina, and its feedstock and production plant is right on industrial Asia’s doorstep... The company has already developed 99.99% (4N) HPA in its labs using its abundant feedstock and its patented production technique. Now the company, capped at just $10M, is accelerating its plans to establish a 3,000tpa production plant and could begin production in 2016. In the meantime, we are looking out for a Bankable Feasibility Study, approvals and offtake agreements to come... This is a case of right place, right time, and right product:

Altech Chemicals Limited (ASX:ATC) plans to become a producer of technology related chemicals, and its starting with High Purity Alumina – or HPA for short. The company has recently undergone a rename and ticker change – to bring focus to the innovative technology it has developed to produce HPA. Regular readers may recall the company as Australian Minerals and Mining Group Ltd (ASX:AKA) from The Next Mining Boom

. In light of its advancement towards becoming a producer and seller of HPA, a name change and rebrand was due:

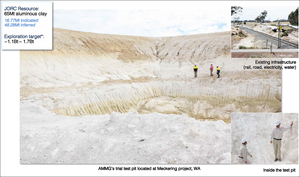

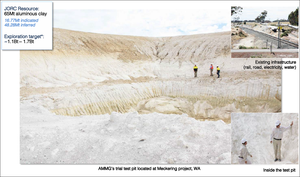

ATC owns 100% of a 65 Mt JORC resource of aluminous clay feedstock in Meckering, Western Australia and developed a unique method to turn this material into 4N HPA.

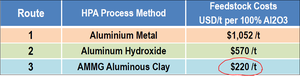

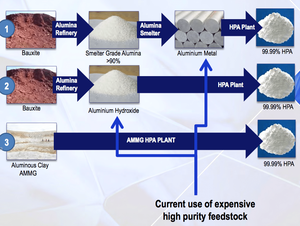

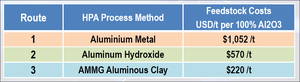

Now, ATC is accelerating its plans to become a top three global producer of 4N HPA starting with a Bankable Feasibility Study to bring a 3,000 tpa plant into production. ATC’s point of difference is the costs to produce its HPA – helped by Mother Nature in arid WA conditions, the feedstock has already been processed and purified for thousands of years. Due to its unique process, and aided by the characteristics of its aluminous clay resource, ATC’s processing method is much cheaper than competitors’ methods:

And as you’re about to see, ATC is well positioned to carve a big slice out of the HPA market...

Our Track Record

Did you see our Next Tech Stock article on Ziptel (ASX:ZIP) ? ZIP has been up as high as 160% since we first released our article:

Source: Etrade Australia

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

All the way with HPA

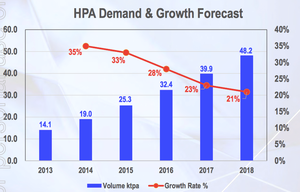

As our world embraces higher levels of technology, HPA is becoming a crucial ingredient – valued for its strength, durability and flexibility. ATC is planning to become a producer of HPA right as demand for it increases. A report from Technavio predicts a huge uptick in HPA demand in the next four years – just when ATC could be going full pelt with production of 4N grade material from their planned 3,000 tpa plant:

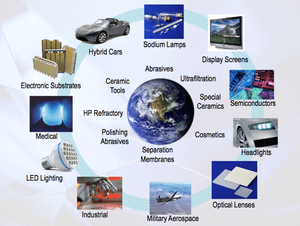

Technavio puts global demand in 2014 at 19,040tpa – but fast-forward to 2018 and that demand sits at 48,230tpa – a 153% rise. There are lots of uses for HPA, covering a diverse range of high tech industries:

Sapphire glass smart phone displays

But the best way to explore the reasons behind the growing demand for HPA is the newest application for it – sapphire glass Smart Phone displays.

Most smart phones right now have Gorilla Glass – made from toughened glass. But as you know if you’ve ever dropped one of the things, Gorilla Glass can scratch and break. But sapphire glass – made with HPA – is much more scratch resistant and, best of all, it’s also more flexible. Apple was aiming to introduce sapphire glass with its new iPhone 6 but a supply deal for the material didn’t work out. However, the ambition to get sapphire glass on Apple phones is very much still there – Apple remains committed to sapphire glass , already uses it on the camera lens on the phones, and is expected to implement in Apple watches, due to be released next year:

Plus sapphire glass may be implemented in the iPhone7 :

There are estimates that up to 30g of HPA would be used in the production of an iPhone sapphire glass screen and, with 300 million iPhones sold between 2013 and 2014, if Apple decides to use this material in the next generation of iPhones, ATC could be in a strong position at the same time its production of HPA is planned to start. But it’s not just Apple, the HPA dependant sapphire glass race continues – especially now that $16 BN Japanese phone maker Kyocera just brought a sapphire glass device on to the market:

Oh, and the largest telecommunications equipment maker in the world, Chinese giant Huawei is getting set to launch a sapphire glass smart phone cover:

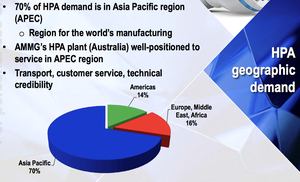

So it appears that sapphire glass phone displays are coming on stream as the new must have feature on the next generation of smart phones. Remember, it’s estimated that 30g of HPA would be required for an iPhone sapphire glass screen – and 500 million smart phones are sold per year... This market represents a significant growth opportunity for ATC as it works to bring its production of HPA on stream. And in the HPA game, geographical positioning is also very important – 70% of the demand for HPA is in the Asia Pacific region, which is where most of the world’s smart phones are made:

ATC is based in Western Australia so it’s right in line with the Asian markets that dominate demand for HPA. As the vast majority of the world’s electronic devices are made in Asia, having a supplier in the same time zone is a big advantage for the region’s phone makers – and ATC. Plus, as a vertically integrated operation, ATC could be able to control and then make money from every stage of HPA production...

Our Track Record

Regular readers of our sites will be familiar with our long-standing interest in high potential stocks. In addition to ZIP mentioned earlier, here are a few more:

- Since the Next Oil Rush article on Real Energy (ASX:RLE), International Feeding Frenzy in Australia’s Hottest Shale Gas Region Puts Undervalued Junior on M&A Radar , RLE has risen as high as 110%.

- Since the Next Small Cap article on Core Exploration (ASX:CXO), BHP Circling... Micro Cap Neighbour to Drill Mammoth Targets , CXO has been up as high as 140%.

The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

Mine, process and produce – ATC’s HPA advantage

The most defining characteristic with HPA is its purity – the more purer the product, the more you can charge. ATC is aiming for the higher end of the scale:

99.99% pure HPA is known as 4N and it sells for up to $50 a kilo. This is ATC’s target product and market. To get 4N product and produce it on a mass scale, ATC plans to use its very own supply of aluminous clay feedstock and its in-house processing method. ATC have a 65 Mt JORC inferred and indicated resource – a large pit of aluminous clay, just begging to be processed...

This means it can mine, process and ship 4N HPA. Most of the world’s HPA is extracted from bauxite but ATC’s aluminous clay deposits offer a clear advantage owing to Mother Nature’s charms – it’s far easier and cheaper to get HPA from clay than bauxite, and over thousands of years, ATC’s feedstock has been purified by natural forces:

Another reason why ATC can keep their production costs low – they have the feedstock, and they have the process. ATC has developed a trial pit at Meckering (see the photo above) and has been extracting aluminous clay – also known as kaolin – and sending it to Perth where its pilot processing facility is making small batches of 4N HPA for demonstration to potential customers. In a nutshell, ATC extracts the aluminous clay and runs it through a long series of filters and acid washes, roasts it, cools it and then hey presto – out comes HPA.

ATC’s process is very different to the usual ways of its competitors. Most of them use bauxite as the alumina source, which needs more intense and costly processes for extracting HPA. But with clay it’s mostly about filtering – something that cuts costs significantly and could allow ATC to have a higher profit margin. ATC use Route 3 in this chart, which as much cheaper costs:

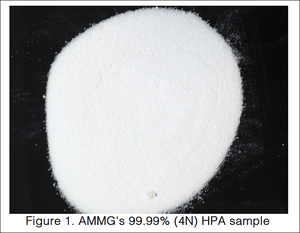

ATC has already successfully produced HPA to 4N 99.99% purity using its innovative aluminous clay to HPA processing technology.

It proved its technology and attracted international attention. Now it’s planning to ramp its small-scale process up with a 3,000tpa plant and has just appointed a team to produce a Bankable Feasibility Study (BFS) to get the project moving.

The BFS is expected to be complete by Q3 of 2015, after which ATC should be accelerating its plans to build the processing plant to start producing and selling.

Next in the pipeline

ATC is charging ahead in its plans to produce 4N HPA and deliver it to the hungry world markets. This all starts with the Bankable Feasibility Study for a 3,000 tpa plant. We’ll be looking out for progress updates on the BFS work and also any more trials or demonstrations of the 4N HPA producing technology for off-take customers. We will also be waiting for our HPA infused sapphire glass phone display – one that doesn’t scratch...

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.